October 2025 Almond Market Update

October’s Position Report showed year over year growth in shipments to export markets with volume increasing +5.2% in October. Meanwhile domestic shipments continued to lag and were off -28.5%. Combined, net shipments of California almonds were down -3.6% during October and are off -5.6% on the crop year.

Total crop receipts neared 1.7 billion pounds. This is -7.97% behind the volume seen last year and reflects a slower pace of receipts during October than a year ago with total crop receipts off just -4.12% at the time of September’s Position Report.

Total Commitments are -16.65% behind last year. Commitments to export markets are behind -20.92%, while domestic commitments are off -7.54%. While net commitments lag year over year, monthly purchasing continues to remain strong and within historical bounds. During the month of October, purchasing activity topped 261 million pounds.

Harvest

Crop receipts to handlers during October present some supply-side uncertainties. As we previous noted in our last Market Report, expectations on the ground in California had been coalescing in the 2.7-2.8 billion pound range, roughly the same as last year, but below the 3.0 pounds forecast in the Objective Forecast. We continue to project plus or minus 2.7 billion pounds. But total crop receipts are now -7.97% behind YoY after a slow October.

California has seen more precipitation during the past two months than is typical. This may well have contributed to delayed processing. With significant stockpiles remaining to process, crop size is still very much unknown. But while processing may be delayed, wet weather during harvest also increases the risk of mold and pest infestations, particular in late-harvest varieties including Monterey and Fritz. This could lead to another year of higher rejects and damaged kernels, further eroding available inventory.

November will be a critical month to provide clarity on the eventual crop size. A 2.7 billion crop is needed to have any possibility of maintaining shipment levels from a year ago. If receipts continue to lag supply-side pressures will only continue to tighten.

Export Markets

Indian buyers returned to the market in October accounting for 28 million pounds in shipments during the month. While this was slightly behind the volumes seen in October 2024, the volume pushed the growth rate from -39% in September to -29% in October. Local supply chains seem to have rebalanced after the changes to the goods and service tax and producers are beginning to look to resupply after Diwali. Consumer demand remains strong and we are not observing any fundamental shifts in consumption preferences, supporting expectations that shipment volumes should continue to stay elevated through the New Year.

Elsewhere in the region, Pakistan continues to emerge as a growth market and is up +200% on the crop year having imported nearly 6.3 million pounds.

Shipments into Southeast Asia saw significant acceleration in October. October volume was up +90.4% YoY with importers adding almost +11 million pounds to volumes seen last year. As a region, SE Asia is pacing +73% on the crop year. The region’s largest market, Vietnam, is up +94% on the crop year, as is Malaysia, while Thailand is up +101%.

The region’s markets continue to provide a valuable processing services into China with tariffs providing incentive to Chinese buyers to look for alternatives other than direct import. Our buying team reported strong interest during October to these markets to support production ahead of Lunar New Year.

Direct shipments into China continued to fall and shipments are now down -75% on the crop year. When taken as a whole, shipments into SE Asian markets and China are relatively stable YoY (+0.57%), though shipments are off -10.1% for the collective over October 2023 figures. But this suggests that Chinese buyers have built workable alternatives to direct importations and we should continue to see shipments shift into these developing SE Asia markets.

Western European markets have experienced a +31% growth rate on the crop year with October continuing to accelerate that pace. European buyers have added nearly +32 million pounds over volumes imported a year ago. Spain, Europe’s largest importer, has enjoyed a +52% growth rate on the crop year and topped 43 million pounds of imports. The Netherlands (+16%), Italy (+10%), Germany (+23%), UK (+44%), and France (+83%) are all experiencing growth.

Imports into the region may slow in the short term as new shipments won’t arrive in time for holiday production. Buyers had generally been operating hand-to-mouth though before holiday buying began and it remains to be seen how much of this volume may be intended to support post-holiday production and provide some flexibility should pricing become volatile. Either way, our sales team reports continued investment in production capacity within Europe, suggesting long-term growth.

Middle Eastern markets began the crop year on a buying spree. In August shipments were up +68% YoY representing an additional +7 million pounds. This corresponds with a general dip in almond commodity prices that fell significantly in July before reversing in August and generally continuing since up +20% on the crop year. This may have kept importers cautious as the three largest markets in the Middle East, UAE (-5%), Turkey (-19%) and Saudi Arabia (-24%), now all see declines in shipment volume on the crop year. As a region, the Middle East is off -10%. With buyers looking ahead to cover needs for Ramadan, our sales team has advised that buying interest within the region has begun to pick up. We expect shipment volumes to the region to rebound as buyers are forced to plan forward inventory coverage.

Morocco continues to recover its shipment volume and is now up +121% YoY for the crop year. The 14.5 million pounds imported through October is the most during this time period since October 2022 when buyers had imported 13.6 million pounds. Morocco continues to enjoy the largest per-capita consumption of almonds and buying patterns appear to be returning to historical patterns.

Market Conditions - Beauty is in The Eye of The Beholder

Is it a bull or a bear? Markets are going to be grappling with this question probably through November. There's quite a bit to consider and how you view the market is going to depend on how you interpret what's going on. Let's take a look.

Supply-side

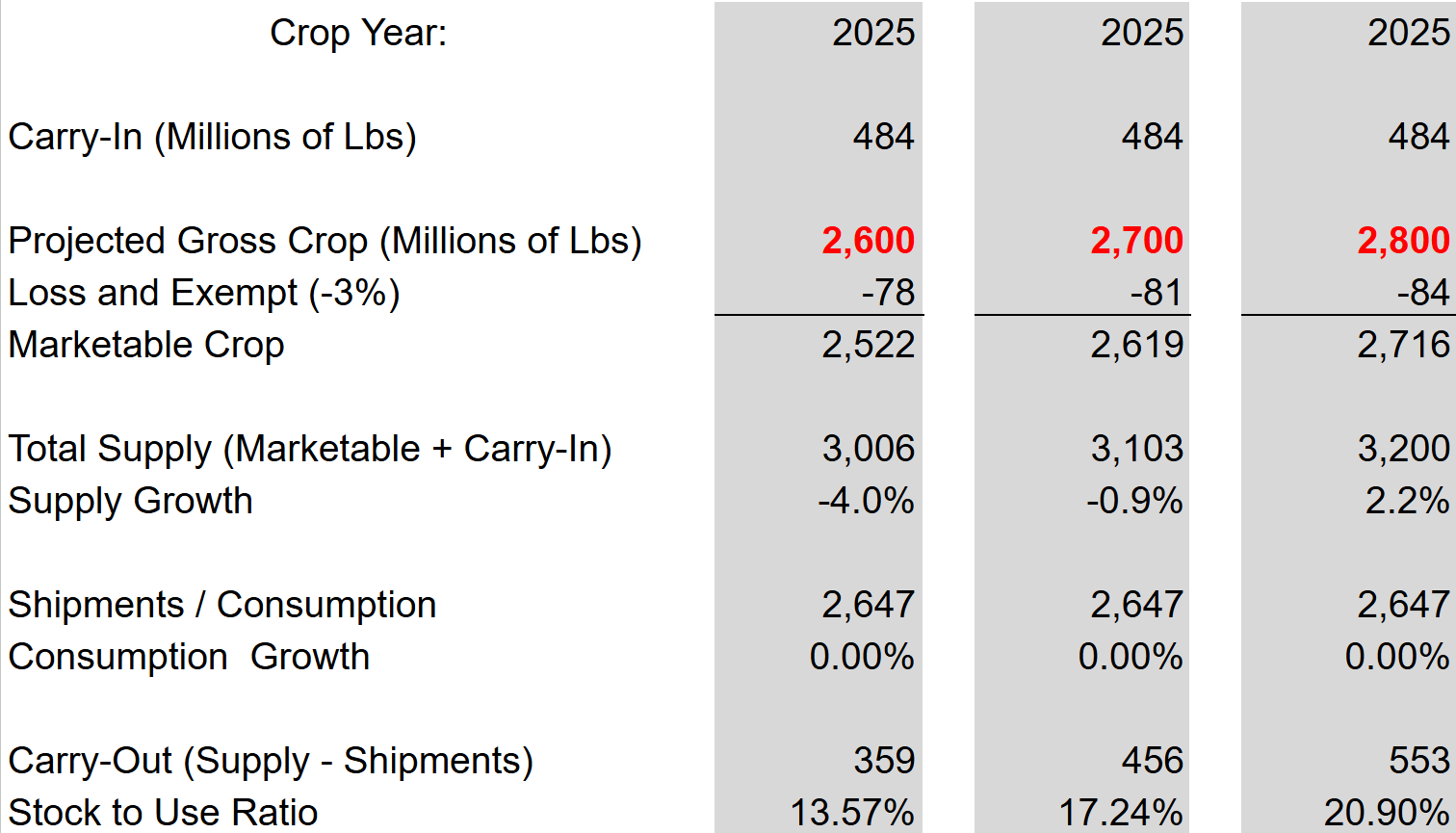

California handlers brought almost 484 million pounds of almonds into the new crop year. This equates to an 18.3% stock-to-use ratio (Carry Forward/Total Shipments). 20% has been our benchmark for a balanced supply scenario, with an 18.3% figure representing a tight supply reality. For the industry to have an equal supply as last year, crop receipts would need to fall near 2.7 billion pounds. While the Objective Forecast projected a 3.0 billion pound harvest, consensus from California growers had been consolidating around 2.7-2.8 billion pounds. We continue to project a harvest volume plus or minus 2.7 billion pounds. But notice how that impacts a projected stock-to-use ratio assuming no shipment growth through the end of the year:

What we can see is that further erosion of the eventual crop quickly puts the industry into a particularly tight supply situation when holding shipments flat year to year, so projecting eventual crop size is of particular importance.

The current position report shows crop receipts are off -7.97% YoY. As we noted earlier in the report, this does not yet mean the crop itself is off this much, but it certainly raises the level of risk. Those betting on a crop closer to the Objective Forecast would certainly have preferred to see more receipts curing October.

There may also be supply concerns laying on the horizon for inshell buyers. Inshell has historically enjoyed a premium over kernel equivalents. That has not been the case recently and we're seeing growers shifting their production away from inshell. In a scenario where demand rebounds and persists at an elevated level from Indian buyers, shortages of inshell product may become a reality.

Demand-side

Net shipments are off -5.62% on the crop year, lead by domestic shipments which are down -21.16%. It is apparent that domestic producers are rebalancing their product mix and recalibrating to a new consumer sensitive to persistent inflation. Almonds retain strong consumer sentiment and value proposition, but broad increases in input prices, including other ingredients in products where almonds are also used, has necessitated the rebalance from producers and retailers.

Significant declines in shipments to domestic buyers began in earnest in March. As we enter the spring we expect shipment volumes to begin aligning with previous year's volumes. In other words, while we're not expecting growth within the domestic market, we don't expect a -21% pace to continue once shipments balance the new production reality; thus, the cumulative drag on net shipments will begin to soften.

On the other hand, export shipments are up +0.71% after a strong October where California handlers shipped more than 249 million pounds on net. This is in spite of India being down -29% and the Middle East declining -10%. Western Europe is unlikely to continue to drive demand growth in the same way that it has, but fundamentally EU markets are mature and retain strong consumption preferences for almonds. Meanwhile India has become more active as it works beyond Diwali and the Middle East appears uncovered ahead of Ramadan. Which markets are active might continue to oscillate, but on net, global demand for almonds continue to be strong.

Summary

Uncertainty prevails in the market, but global demand continues to be strong. We can observe this in depressed commitment numbers, but monthly purchases that remain within historical ranges for this time of year. Handlers will continue to be cautious about overextending commitments while buyers will likely continue to operate hand to mouth. Both will look towards November for additional clarity on eventual crop size with risks present on side of the equation.