February 2023 Almond Market Report

Strong Shipments (Again)

February’s Position Report shows that California handlers set a February record shipping 245.7 million pounds. This is +23.4% above last February. Export markets once again led the way accounting for 188.3 million pounds growing +29.3% YoY. Domestic shipments also saw YoY growth increasing +7.6% while nearly topping 56.5 million pounds. On the crop year, export markets are pacing +10.4% growth while domestic shipments are lagging -5.5%. On net, California suppliers have shipped +5.5% more almonds on the crop year than a year ago.

The pace of new commitments slowed in February with the Industry adding just over +190 million pounds in new contracts. While this is a far cry from the record setting January pace of +350 million pounds, February’s +190 million compares more favorably to last year’s +215 million pounds and +188 million in 2020/21, indicating that buying has returned to a more normalized pace. Considering markets have seen an average of +$0.20 movement since last month, a less frenzied buying rate seems more natural anyhow. Total committed inventory now stands at 784.7 million pounds, which is -8.5% behind where the Industry was a year ago.

Crop receipts for the season have topped 2.522 billion pounds up less than +50 million pounds from a month ago. Any additional gains are going to be inconsequential unless your over/under line in your office pool is 2.55 billion, then perhaps you’re waiting for March’s Position Report with baited breath. Current supply is well understood. Future supply is where the waters have become more murky…

Bloom

Cooler and rainy weather at the end of January helped push the start of bloom back 10-14 days on average later into February than we saw last year. This shift was observed consistently across all California growing regions and impacted all varieties. As of writing, petal fall has already begun on most varieties with later blooming varieties likely progressing by the end of the week.

In the Northern region, where frosts had hit hard last year, bloom was especially robust. This had been expected as bud wood moving into winter had been observed as being strong. Central and Southern orchards have reported solid blossom levels as well with plenty of chill hours having occurred this winter.

Weather conditions however present some uncertainty regarding how successful the pollination event will be. The back end of February saw widespread weather that was colder than average and a return of consistent wet weather. Snow was even observed on the valley floor and low elevation foothills which is all but unheard of. High winds, hail, even graupel (author admittedly had to look this up) have been consistent talking points from the far south, to the very north. Far from ideal weather for pollination.

Bee flight hours have thus become a consistent industry concern point. Honeybees aren’t especially active below 55 degrees Fahrenheit. Cloud cover, wind and rain will further suppress bee activity. Sunny, calm and mild weather with ample time above 55 degrees has not been the norm this season meaning the number of hours that bees have been the most active are well below historical averages. This is especially true in the Central and Southern regions that historically see fairer weather conditions on average than the North.

Wind, heavy rain, hail and frosts can also impact the blossoms themselves. Pollen can be washed away, petals and blossoms knocked off and plant material destroyed. Thankfully freezing temperatures have not been a real issue this season as high moisture environments when overnight temperatures have fallen have helped mitigate any damage threat like we saw in the North last season.

Where wet and unstable weather is more common in the North, growers seem to hold on to some optimism that an average yield might be a reasonable outlook. They are used to rain and wind after all. Central and South Valley growers are not, and they are beginning to sound the alarm as system after system has brought additional rainfall and cooler temperatures to their regions. More rain is already spreading across California and should linger into the weekend with another storm forecast early next week. While these systems will bring warmer weather than recent storms, and therefore increase the odds of some periods of fair weather between storms, there is real concern in the south that the damage may already be done. It is far too early to make a reasonable assessment on how these weather events have impacted future yields, but it is already clear that this will not be a record setting season and real risk exists for a quickly tightening supply scenario moving forward.

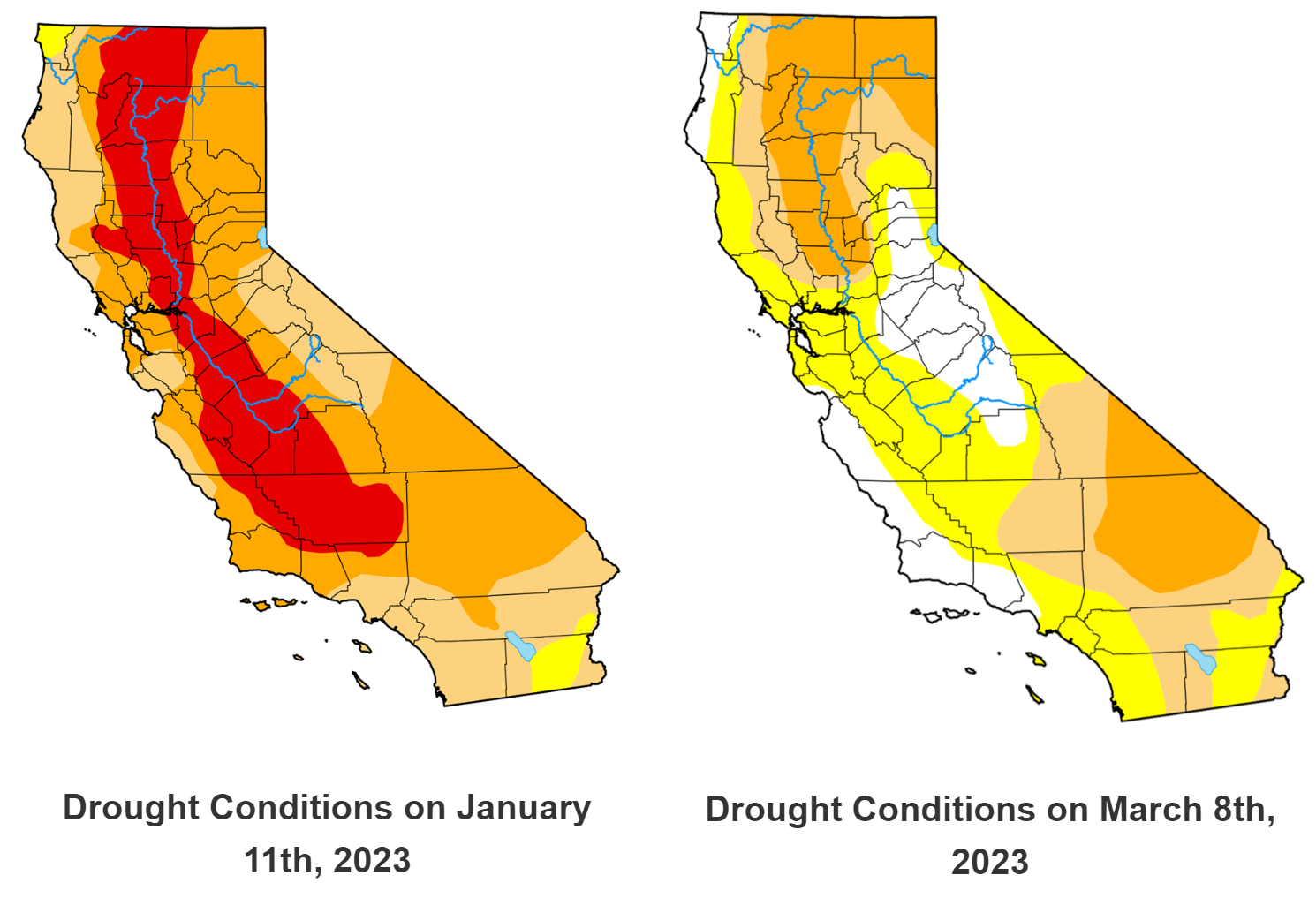

Drought (Unofficially) Over

February had periods of dryness, but gave way to wet weather that has continued into March. As of March 8th, 16.7% of the state has actually exited any drought designation. These areas are found along the coast and in the Southern/Central Sierra Nevada mountains. While most of the state (and most almond growing regions) still carry a drought designation, it is clear that this winter has had significant, and quite positive, impacts on easing the long standing drought in California. Here is a quick comparison of drought conditions on March 8th compared to January 8th.

California’s snowpack has been the darling of the season. According to California Department of Water Resources data, the State now averages 192% of normal for this time of year. With April 1st being the traditional peak of the snow season, California now has 181% of its seasonal total. The Central and Southern Sierra have seen the bulk of the weather with the Southern region reporting 230% of normal and the Central region 196%. While lagging by comparison, the North also shows a robust 156% of normal.

Most of California’s primary reservoirs that hold water for dry season deliveries to valley almond growers are at or above their historical averages for this time of year. This now includes Lake Oroville, California’s second largest reservoir, that in 2021 reached it's lowest recorded level. The reservoir had struggled to rebound back to historical averages even as wet weather had persisted, but is now up over +178 feet since December 1st and water managers are warning releases over the main spillway could begin by the end of the week. (A spectacular site if anyone happens to be in the area.)

However, Shasta, and sister reservoir Trinity, are notable laggards at 83% and 47% of their respective averages for this time of year. Both will benefit from spring runoff, which should be significant considering the snowpack, but these reservoirs are in the north where the snowpack has been lighter than in other regions.

The water reality in California has taken a complete U-turn. While officially drought conditions still persist in much of the state, it is clear at this time that reservoirs will be full by summer. Significant precipitation is forecast through the weekend with another right on its tail early next week. Water districts have already begun increasing their delivery allotments above where they have been and it seems all but certain that additional increases are to come. Full reservoirs certainly ease water concerns for this coming growing season and should also provide a buffer should another dry season materialize next winter.

Export Markets Fueling Growth

China

China is an example why numbers and trends don’t always tell the whole picture. Or at the very least a reminder of how quickly things can change. Our Sales team has given anecdote after anecdote that China was awakening and strong interest was coming from the market. Their observations seem to have been validated. Chinese imports topped 21.8 million pounds in February, falling behind only India (34m) to claim the second position in net monthly imports in February. By comparison, China imported only 4.4 million pounds last February growing at a pace of +442% YoY in February.

China is now on par with its net imports on the crop year from a year ago erasing a -20% deficit just a month ago. On the crop year, China is still favoring kernels with kernel shipments up +30.8%, but February’s importation of over 13 million pounds of inshell almonds suggests that the Chinese market still has interest in inshell.

India

India imported +68.9% more almonds in February than it did a year ago. Imports topped 34 million pounds propelling India to a +5% pace on the crop year when the subcontinent was showing -2% just a month ago. Strong demand from Indian buyers is welcome news to California almond handlers, and while almond prices have rebounded from their lows, they remain historically underpriced. This should help continue to fuel demand, especially if relative stability can continue with the Indian Rupee after continuing to see its value erode against the dollar.

Western Europe

Western Europe Markets posted very strong shipment numbers in January. For a reminder, revisit our last Market Report. If you were to simply compare January’s YTD growth figure of +10% for the region to the +4% now showing after February’s shipment period you may be ready to sound alarms. The Region’s 50.5 million pound import figure in February, while -19.8% below last year’s February shipment figure, is -9.9% below last month’s figure. This could suggest that the last two months combined were accounting for a more concentrated demand spike seen the year prior. While that’s one hypothesis, we know that demand cycles are not as cyclical as they were prior to the Covid era, so this may be an incomplete explanation.

In either case, the region remains above their shipment figures from a year ago and by and large, Western Europe’s largest markets are seeing growth. Spain, the region’s largest, is +17% on the year and Germany in the second position is up +4%. The Netherlands as the third largest market is the only current top-5 market seeing a decline and is off -4%. We use ‘current top-5’ because the UK, which paced the region as the 5th largest market a year ago is off -15% and has been replaced in the rank by France, which itself is seeing +34% growth. If you combine France and the UK’s figures as a means to balance the UK’s decline with France’s growth, the combined markets are up +5.4% on the year.

Middle East

The Middle East imported over 31.7 million pounds in February growing +111.7% from a year ago and adding +24.5% over January. On the crop year, the region is up +54% on net. The region’s growth has been fueled almost entirely within kernel varieties, which have grown at a rate of +53.5% compared to inshell shipments that have grown at just +4.1%. All top markets in the region have shown significant growth. The UAE has topped 85.9 million pounds with a YTD growth rate of +47% and Turkey is growing at a +54% rate having already imported over 46.8 million pounds on the crop year. The other top markets of Saudi Arabia, Jordan and Israel are on pace for growth rates of +95%, +93% and +11% respectively.

Supply and Demand are Coming into Balance

Almond prices have seen a rebound over the past month adding +$0.20 per pound on average. This was fueled at first by continued positive demand pressure with growth having materialized in several key export markets as evidenced by previous Position Reports. With shipments again exceeding Industry expectations and handlers having worked through their historical carry forward, the oversupply narrative that has dominated trading for far too long may well be put to rest.

At the very least, handlers are likely to become more reluctant to move tonnage simply to clear space. The current weather pattern has sown widespread concern that pollination will be underwhelming. Continued wet weather may further hamper cultivation work that has also been eroded with ongoing farming budget cuts from years of historically low commodity prices and exceptional inflationary pressure. Warmer weather appears on the horizon, but is also forecast to remain wet adding disease pressure that growers may struggle to defend against adequately. Furthermore, these impacts are likely to be felt across most, if not all, growing regions meaning potential impacts on orchard yields could be particularly widespread. Taken together, the variables facing the growing community will likely mean handlers will be cautious about overselling what they currently have on hand until a clearer picture of eventual yield comes in to focus with many likely waiting until the Subjective Forecast later in the spring before making any strong moves one way or another.

In the short term this is likely to put upward pressure on almond prices. Buyers that are operating hand-to-mouth won’t have a choice and will be forced to buy into the price swing. Others that have some inventory in flux may choose to wait for new contracts in hopes that the coming forecasts ease some of the grower’s worst fears. This may result in slower commitments being added in the short term as well. However, it should also be noted that on net Export markets are -10.7% off their commitment levels from a year ago while also driving the demand growth shipping +10.4% more on the crop year. Is this bump in shipments from export markets a result of buyers staying ahead of their demand while commodity prices were low, or has it been reactionary to on-the-ground demand? How much, if at all, shipments slow in the coming months may help clarify that question. Continued strong demand will only continue to fuel price increases.