December 2025 Almond Market Report

Happy New Year From Our Team!

The December Position Report shows that California handlers shipped over 245 million pounds in the holiday-shortened month. This volume was up +5.4% on net over last December and was the second largest December on record. Domestic shipments continue to lag behind last year’s figures. December shipments were off -12.4% YoY and the domestic market is now pacing -18% on the crop year. Export shipments on the other hand saw significant growth over last December up +11.1% while recording the largest volume for the month of December on record. Shipments across all markets are down nearly -6.5% for the crop year.

Crop receipts for the crop year rose to 2.51 billion pounds closing the gap between received inventory YoY from -6.6% observed in November to -2.46% in December. A combination of slower shipments and lagging receipts has on-hand computed inventory essentially flat from this time a year ago. Commitments however remain behind last year with total committed shipments off -11.58% YoY, providing handlers +4.4% more uncommitted inventory left to sell than a year ago. While commitments lag, monthly purchasing activity remains within historical bounds with 196.6 million pounds being transacted in December, up +7% YoY.

Weather Considerations

California’s rainy season has been a damp one thus far for California’s Central Valley. Persistent dense fog lasting for days on end and significant widespread precipitation have helped December be one of the wettest on record and has completely eliminated drought conditions across all corners of the state - something that hasn’t happened in nearly 20 years. While reservoirs are generally well above seasonal averages for this time of year, the storms have been on the warmer side and California snow pack looks especially light in some locations. In the Northern Sierra as an example, snow pack was reported at just 58% of normal for this time of year as of January 13th. As wet as the season has been in the valley, the Southern snow pack is just at 101%. While full reservoirs and a wet valley are positive signs for water availability, colder storms capable of increasing mountain snow levels will be welcomed as California heads into its typically wettest months.

Persistent moisture raises concerns about elevated levels of pest and mold damage. We had observed elevated levels of rejects in our November Report and we continue to see elevated levels in the December Position Report with the current crop year average at 2.6% (above the industry forecast of 2% that estimates available inventory). This means that an additional reduction should be factored in when reviewing industry inventory levels to account for the higher levels of loss.

But serious damage/rejects aren't the only consequence. Quality in general could suffer, putting strain on the high end of the quality spectrum. Markets looking for premium quality will want to pay attention to the availability of their preferred specification and may want to factor in an additional level of risk regarding late season availability.

Crop Size

Harvest began delayed and was weather impacted. Crop receipts that were off nearly -8% in October have recovered to -2.46%. The accelerated processing began in November and continued through December. With receipts already topping 2.5 billion pounds, concerns of an overly short supply are going to subside baring any Black Swan come the January Position Report. But at the same time, any expectation that crop size would eventually produce a surplus is effectively off the table as well.

Last year the industry received from the field just 137 million pounds between January and July and had received 95% of its eventual crop by the December Position Report. This late season slow down is structural and quite typical. While it is perfectly plausible that processors will process more volume heading into spring than they did a year ago, a doubling of volume wouldn’t even produce a 2.8 billion pound crop. We continue to predict a 2.7 billion pound crop with a range between 2.65 and 2.75 billion pounds. This would put the industry in a similar supply scenario as a year ago with a small shortfall depending on where the final number comes in.

Export Markets

India

Indian buyers imported almost 33.8 million pounds in December, off a modest -2.5% YoY. India’s return to the market has been significant and has helped shipment volume on the crop year to improve to a -15% pace. Even with a strong buying month, Indian buyers have generally been more selective ahead of the Position Report with much uncertainty regarding eventual supply lingering ahead of its release. Cautious buying has left local markets particularly uncovered with spot prices in local trade soaring well above market price from California. With California supply in better focus, Indian buyers will be looking to resupply.

But Indian buyers are going to face two big obstacles. In the immediate current shipping delays are going to continue to put pressure on local spot market and prompt purchase increasing the urgency to resupply in short order. In the short term, the bottle necks may simply be throughput capacity of inshell handlers looking to respond to increasing Indian demand. In the long term, something more consequential looms.

We continue to project a tightening supply situation for inshell product over the duration of the season. Growers facing financial pressures and a lack of price premiums for inshell product during harvest have shifted crop to kernels and away from inshell. The degree to which this has occurred is still unknown, but the grower community has continually conveyed to our team that many in the industry felt this pressure. Traditional inshell suppliers may not have the volume they historically have had to supply inshell buyers. Paired with a resurgence in Indian purchasing, there is real risk of a supply pinch as we progress into the spring and summer.

Western Europe Review

After taking a reprieve from their torrid buying pace to begin the crop year, Western European buyers returned to a more normal buying patterns. Regional buyers imported over 62 million pounds in December, up +3.5% YoY. On the crop year, EU markets are now flat YoY.

Spain, Italy and the UK each saw increases in December shipment volume from a year ago, while the Netherlands saw significant declines and Germany was flat.

On the crop year, Spain has impressed with a +20% growth rate. As too has Italy, up +21% and currently ranking as the regions second largest importer behind Spain. But the Netherlands is off -38% and Germany is off -6% for the crop year.

The UK (+19%) and France (+2%) are all markets to watch, but keep an eye on Belgium as well, which is up +56% on the crop year and has already caught France as the sixth largest EU market.

Local EU almond production continues to develop. Growers in Spain and Portugal experienced record harvests this crop year providing European buyers with an increased local supply. But the increase in local product have not damped demand for California almonds. Imported shipments from California remain on par with last year's shipment volumes. Spain, itself with growing levels of local production, is up +20%.

Local spot markets are also charging significant premiums over California market prices, signaling local supply chains are experiencing tight supply. This would suggest that whatever impact that local production would have had on demand from California has already occurred and that future looking demand is likely to remain strong as local supply chains look to cover their positions.

We are also tracking delays in transportation times which could also continue to stress local spot markets and motivate buyers back to the market needing to account for additional transportation times.

An Evolving China Ecosphere

China continues to shift its supply chain to account for elevated tariff fees and economic uncertainty between the US and China. Shipments directly to China have continued to fall and are off - 65% on the crop year totaling a decline of nearly -25 million pounds.

Southeast Asian markets like Vietnam (+73%), Thailand (+26%), Malaysia (+57%), and Indonesia (+24%) have all seen significant growth as they continue to develop with growing demand as value added markets for Chinese buyers. As a region, SE Asia is up +52% on the crop year, roughly +24 million pounds, effectively balancing the decrease in direct-to-China shipments observed so far this crop year.

While the industry is largely accepting of the conclusion that SE Asia market growth is being driven by a shift in Chinese buying patterns, there remains a lack of clarity as to what degree China is driving this growth. In other words, how much product going through these SE Asian markets end up in China? While it is convenient to suggest that the full volume of growth seen in these markets is going through to China, doing so discounts market nuance as these markets have growing local consumption as well.

It would therefore be reasonable to assume that Chinese buyers are looking at other sourcing options beyond California-origin for their almond needs, especially where value added processing isn't warranted. China sourcing beyond California origin isn’t necessarily a bad thing for California handlers. Suppliers outside of California are likely able to charge a premium for their almonds to Chinese buyers whose landed costs would otherwise have to include tariffs or additional processing fees from intermediary markets. This effectively raises prices to markets other than China from these potential sources. This in turn limits options for other markets who might might consider supplemental purchasing outside of California.

The assumption of course being that Chinese consumption demand remains otherwise unchanged and/or poised for growth - an assumption our team continues to see evidence of China - but either way it is evident that California’s visibility into the Chinese market is becoming increasingly opaque as more and more volume is being routed through alternative means.

Middle East and North Africa

Middle Eastern markets rose +54.4% YoY, importing over 41.1 million pounds in December. For the crop year the region went from pacing -9% growth to +1% growth in a single month. Turkey saw the largest gains in December, more than doubling its shipment volume from a year ago and nearing 19 million pounds in December. The UAE also experienced a strong import month, handling +36% more volume in December than a year ago. The UAE is now pacing -2% growth on the crop year. Saudi Arabia continued to lag behind its volume figures from a year ago and is now off -42% on the crop year. Meanwhile, Israel continued to see increased shipment volume growing at +155% on the crop year and has established itself as the 4th largest market in the region.

Morocco and Algeria are leading growth in the North African region. Morocco slowed its buying pace in December, but still boasts a growth rate of +41% on the crop year having imported over 32 million pounds so far this year. The growth this market is experiencing is quite significant. It has also become a market willing to pay a premium for Butte/Padre shipments. These products have historically been used by confectionary and chocolate producers due to their round shape. A growing market that values these attributes could put pressure on the traditional users of these varieties.

Algeria had a particularly strong month importing over 4 million pounds and more than doubling the volume it had imported the rest of the crop year. It might be reasonable to write this off as an anomaly, but the region has been experiencing growth and will be worth watching how local markets cope with the influx of supply and whether it can sustain growth.

Ex(port) Factors

To summarize what we're seeing across global markets, we see the following being potential 'X' factors for global almond markets. We'll recap each in this section.

- Extended transportation timelines

- Uncovered local markets creating stress for prompt shipments

- Smaller supply of Inshell product

- Moisture related damage causing tighter supply of premium specifications

We have observed extended transit times and logistical bottle necks within the global transportation network. Consistently we have seen transit time to destination extend 30 to 60 days, or more, beyond standard expectations. With Chinese New Year on the horizon, general shipment demand into China is going to remain high. This could perpetuate the delays that we are seeing to other markets as shipping capacity moves to support Chinese demand.

Extended lead times will put added pressure on global almond purchases as broadly speaking, we have seen buyers purchase in a hand-to-mouth fashion. This can be efficient when operating a just-in-time supply model, but becomes risky in situations like this where expected lead times become extended if the local supply chain can't support.

And indeed we're seeing stress indicators in large global markets, particularly in the EU and in India. Both of these markets are seeing local spot shipments of California almonds fetch significant premiums over market price from California. This suggests that these markets have indeed been operating hand-to-mouth and are not sufficiently covered. With supply in better focus, buyers who had been waiting for supply clarity for fear of strong market movement are going to need to come back to the market and may also be motivated to add contracts well into the spring and summer.

During this report we also touched on a developing reality for the India market and the likelihood that inshell supplies are going to become increasingly strained as the season progresses. The lack of inshell premiums during harvest and years of particularly tight budgets have motivated growers to shell out product that would have otherwise been set aside for inshell markets. Shipments to India have lagged to begin the crop year, but consumption demand remains strong and markets are uncovered. India has a lot of buying to do in the coming months. As their buying ramps up, those looking for inshell product could well find themselves in a very tight situation.

In our Weather Considerations section, we noted that wet weather during harvest and processing have created conditions for elevated pest and mold infestations causing quality concerns. Elevated rejects will suppress the overall supply to a larger degree than is forecasted in the Position Report, but just as importantly, could create pressure for the highest quality specification as the season progresses.

The New Domestic Reality

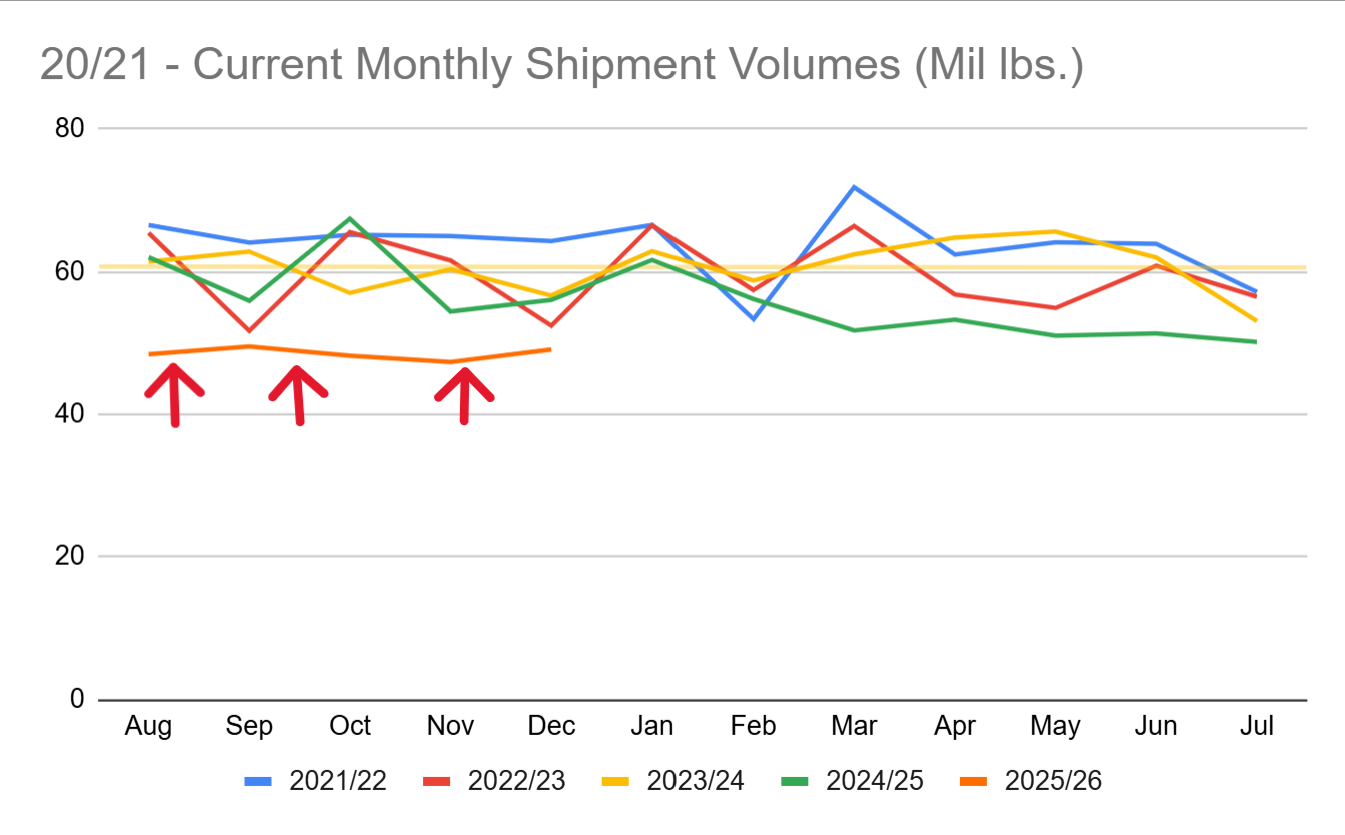

Domestic shipments ended the 2024/25 crop year falling -7.8% and have continued to slip during the current crop year, currently pacing -18%. Viewing historical monthly shipment figures to domestic buyers we can see how pronounced this decline has been to start the crop year:

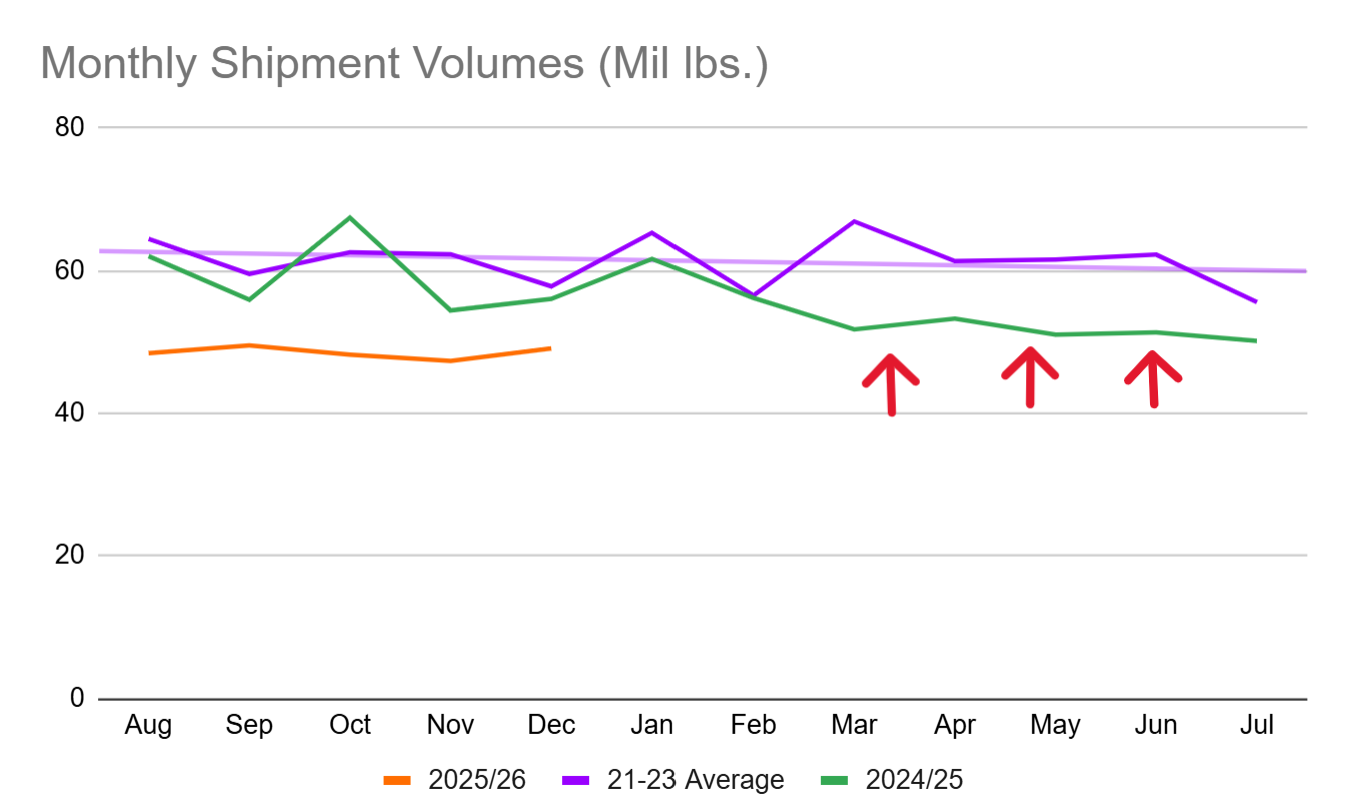

The trend that drove declines last crop year began to materialize in March of 2025 and persisted through the rest crop year. While noticeable in the previous chart, it becomes easier to see when we average the 20/21, 21/22, and 22/23 volumes to reduce the visual noise in the chart. Notice how quickly and significantly shipments dropped below average beginning in March:

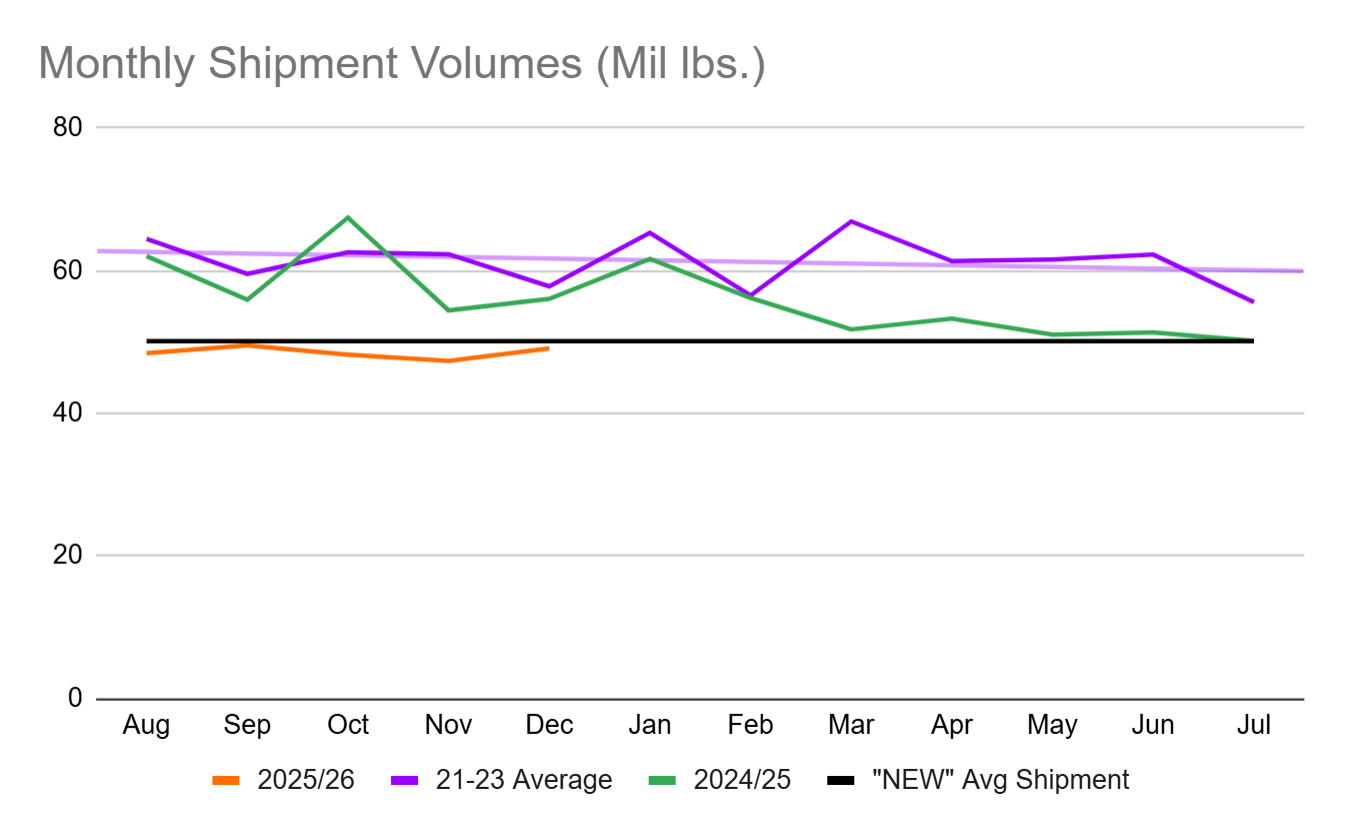

When we look at shipment volumes to domestic buyers since March of 2025 we see a very tight volume band that averages just over 50 million pounds per month. Here’s what that average graphed over the entire crop year would look like. Notice how closely it aligns with the end of the 2024/25 crop year and the start of the current crop year:

This is the new domestic shipment reality. The market isn't in transition - the transition has already occurred. We expect shipment volumes to continue to find this average of 50 million pounds per month average through the remainder of the crop year. Projecting forward a 50 million pound average, domestic shipments would end the year down -11.1%, a modest improvement from their current -18% pace as YoY difference stabilize March forward. This is still a sizable decline for the mature market, but one where ongoing trends make the impacts more predictable.

Market Outlook

We largely see the market as balanced between supply and demand. The December Position Report suggests a crop yield between 2.65 and 2.75 billion pounds. This roughly gives California handlers the same volume as last year. If we sum the carry forward and crop receipts last year and subtract the current carry forward, we calculate that California needs 2.73 billion pounds of receipts to meet last year's supply levels.

Setting aside further debate as to what the eventual receipts will total, if we assume steady YoY supply, what would the industry need to experience to have steady YoY shipments? California handlers would need to ship nearly 1.576 billion pounds through July to meet the shipment levels seen a year ago. Viewed another way, that is slightly more than 225 million pounds per month for the remainder of the crop year. Last year California handlers shipped 214.5 million pounds on average per month during this time period. An additional +10.5 million pounds per month above last year's volume would be needed to meet last year’s annual shipment volume.

Export markets will have to be the driver of this additional lift if annual shipment volumes are going to return to last year’s levels. Domestic shipment volumes have dipped and seem to have found a new average around 50 million pounds per month. As we look forward through the rest of the crop year, to meet a 225 million pound average, export markets would need to average 175 million pounds per month assuming the new domestic shipment reality. Last crop year export markets averaged 161 million pounds per month January - July, implying importers would need to add +14 million pounds per month on average for annual shipment volume to total last year.

Where Does That Leave Us?

With crop size coming into focus, much of the uncertainty and speculation that has been dominant for the past several months should subside as risks of yield falling well below or above this figure have largely subsided. This doesn't mean that full consensus is expected within the market or that modest price movement won't materialize. But as we have been consistently observing, markets are broadly uncovered. Without a black swan supply event lingering in a future Position Report, buyers are going to have less incentive to wait on the sidelines. Further they are already feeling the pressures of operating uncovered as local spot markets heat up and flash warning signs of tight on the ground supply. California handlers are not going to be short of interested buyers.

Many California handlers may also continue to perceive a tight supply scenario. Last year between January and July handlers processed just 137 million pounds of receipts. Should total receipts fall to 2.65 billion pounds, the resulting total supply would come in -2.5% below last year's volume. Furthermore, the Industry recognizes that last year's carry forward volume represented a constricted supply scenario. Ending the crop year with a balanced market would require handlers to actually retain more volume through the transition than it did a year ago, further restricting available supply. The resulting reality is one where an overall annual net shipment decline would be well inline with a balanced market and supportive of a somewhat continued constrained approach by sellers look to balance inventory.

Buyers on the other hand are going to point to shipment volumes that are -6.5% behind those of a year ago and suppressed long term contracts on the books as reasons for sellers to come to the table with more favorable pricing. But market conditions from hand to mouth buying have created pressures in local spot markets and local inventories in many markets are constrained. Buyers simply don't have sufficient leverage to continue to wait out the market for large scale price fluctuations. This doesn't mean that prices will remain constant, just that the risk of supply disruption has shifted more towards local disruptions than large scale disruptions from California creating an environment where buyers will have less cause to be overly cautious in their exposure.

Forecasted forward, this creates market conditions not that dissimilar to what we’ve been experiencing. Modest price variations are likely heading into the spring as different regional demands force buyers to the table, but as of now a relatively balanced market has emerged. As bloom approaches, eyes will start to look to future supply levels and short term impacts will be driven by availability within preferred specifications. Where supply constraints materialize, larger price movements will too.