Select Harvest Almond Market Update January 2020

Clearer Crop Size/Supply

The latest Almond Board Position Report shows crop receipts exceeding 2.385B pounds. Last year crop receipts through December accounted for 97% of the eventual crop yield. Using this same percentage would forecast a final crop size of 2.459B pounds. This represents a supply increase of just over +8% from last year.

It is worth noting that this projected crop size is well above the Objective forecast of 2.2B set by the Almond Board in July. It is however in line with the Subjective forecast and general industry sentiment of yield expectations. It has been our assertion that the market has been trading on a yield above the Objective for quite some. That said, it is natural to ask if this yield clarity is likely to move prices.

Strong Demand

Shipments through December were up 4.36%. This is effectively unchanged from the November numbers and continues the positive demand growth seen throughout the crop year thus far. Export markets are leading this growth with shipments up 6.99% YoY. Commitments however are down -5.61% suggesting on the whole export markets are not well covered. Continued growth in export markets is expected.

Europe continues its strong year holding at +16% with mature markets of Germany and Spain seeing +17% and +21% growth respectively. Perhaps easy to overlook is the India market that after starting the year off -18% has now moved into positive territory with the expectation of continued growth as well. In Asia, Japan has capitalized on reduced importation costs and is currently up +15% on the year. There is speculation that China could reenter the market in short order should the announced Phase 1 Trade Agreement easy tariffs on almonds. This could quickly reverse the downward trend of the Asian Market and put added pressure on the market.

Looking Ahead

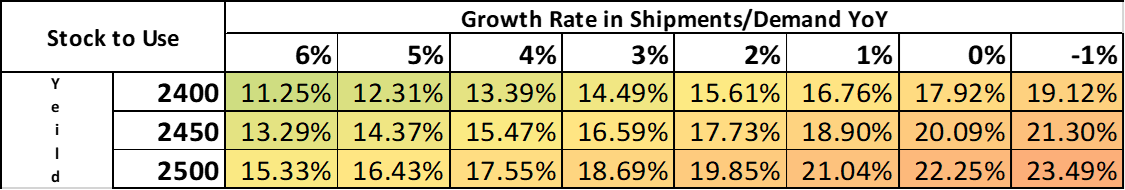

If the Industry continues to pace a +4.5% shipment growth rate, we’ll be on target for a 365M pound carry-forward at a 15.5% stock to use ratio. This historically forecasts relatively stable pricing where 20% indicates Bearish conditions. Of course, future consumption trends are hard to predict. We invite you to participate by making your own assumptions within the chart below.