Select Harvest Almond Market Update December 2021

December Market Update

Per the December Position Report, California almond handlers shipped just over 188 million pounds in December. This is the lowest shipment figure since April 2020, the lowest December figure since December 2016 and marks a -26.5% decline YoY. On net, the industry is -17.29% behind last year’s shipment figures for the crop year. Export markets are leading the slowdown off -22.63% on net on the crop year while domestic markets are essentially flat at -1.97%.

Yearly crop receipts now total over 2.65 billion pounds. Crop receipts since October have trended closely with the 2019/2020 crop year. Using Jan forward receipts from that year would project a yield just shy of 2.8 billion pounds. As an additional barometer, if one assumes that as a percentage, we are equally received as we were last year, he final figure comes closer to 2.85. A final yield between 2.8-2.85 billion pounds seems quite reasonable at this point and should eliminate fears of a Black Swan on the supply side.

Drought

Long-term supply concerns seem to be easing as well. December brought a parade of cold weather storms to California bringing valley rain and heavy mountain snow. Precipitation amounts were a welcome beginning to California’s traditional wettest season bringing notable drought relief. As reported by NBC Los Angeles, areas of California experiencing Extreme Drought Conditions has declined from 80% of the state to 16% of the state since the beginning of December. However, 67% of the state, including almost all of the Central Valley’s almond growing region, remains in sever drought, which as described by drought.gov leads to reduced grazing lands, tree stress and longer fire seasons. While improved, drought conditions persist.

Most locales in Northern and Central California, in or near primary almond growing regions, have recorded well over 100% of average rain fall totals through December. Perhaps more importantly, mountain snow pack and moisture content responsible for refilling California’s reservoirs, are at least 128% of average through December. While this is welcome news, the state as a whole has only account for 55% of precipitation averages through April 1st and most California reservoirs currently sit below average for this time of year.

California is off to a great start already exceeding the previous ‘water-year’ total, and just today, Lake Oroville in North California surpassed the highest water level seen last year. While encouraging, more is needed to return California’s water delivery capacity to historical norms. Nonetheless, the improving water situation has undoubtedly eased concerns about ongoing water stress as growers are looking to the next growing season. We’ll continue to hope for a wet winter and continued drought relief.

Demand

The demand side of the equation has become a drag on price. October, November and now December shipment figures have all shown declines and have been below monthly totals from at least as far back at the 2017/18 crop year. If fact YTD shipment figures are only +2.2% ahead of the ‘17/18 crop year – a year where total supply barely topped 2.61 billion pounds. At an expected yield of 2.8 billion this year, total supply would top 3.4 billion pounds. The simple fact is, there is a lot more to sell this year, and the current shipment pace is lagging.

Commitment shipments lag -11.90% YoY, but this improved from -25.05% in November. Aside from a slow start, commitments have been well within average September and on pace through November. Now in December, commitments have accelerated adding +43% more than December 2020.

Recent price declines are reflective of the relatively undersold position of the California almond market. But it is also possible that we’re seeing a shift in global buying patterns weigh on current market conditions as well. Lingering logistical issues and an early position for Diwali could hint at demand strength in the coming months.

Another Perspective on Demand

What happens when logistical shortcoming force buyers to plan further ahead than they did before? Rhetorical, yes, but the simple answer is they would buy sooner. Logistics aren’t the only market factor that influence when purchasing happen, but it is an important one, and one we’ve touched on in these market reports. Our anecdotal observations have suggested that buyers are in fact buying sooner than they would for future needs. A great question to ask would be, how much sooner?

Consensus in the office was 60-90 days – this is how much further buyers were scheduling their purchases. This is until we took a closer look.

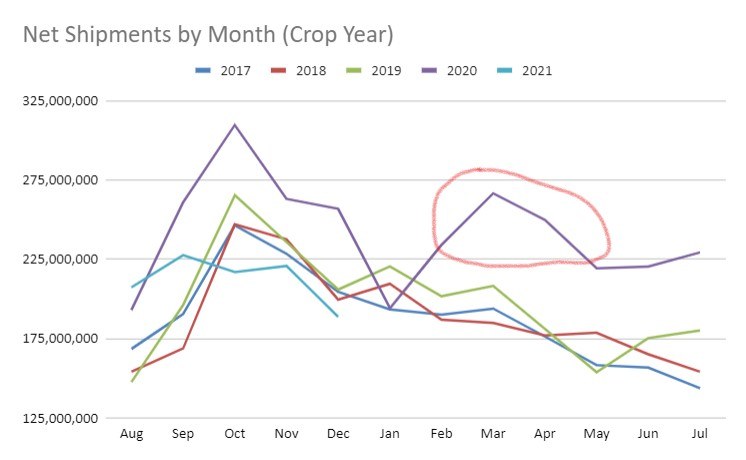

Here’s a simple graph charting monthly shipments over the past few years. Notice the unusual spike we saw in beginning in March last year.

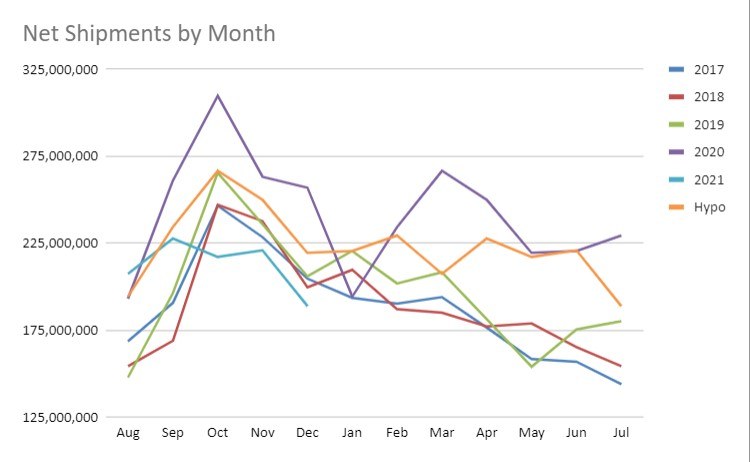

Could this anomalous peak be explained by a global market shifting its buying habits? We were curious. We took shipment numbers from January 2020 to date and shifted them as if they were purchased five months earlier. This would align the March 2020 peak we highlighted in the chart above with the historical peak of October. Here is that same chart with a new trend line representing that five-month shift. It is labeled ‘Hypo’ for hypothetical and colored yellow/orange.

What we find is a trend line that is remarkably consistent with historical shipment trends following a generalize taper from a peak in what was historically October to July. Of course, in this exercise, July is now the December shipment period we just exited. This could suggest that January, now being represented as historically August would lead us into a subsequent three-month period of elevated purchasing. Should such a scenario materialize, the undersold position of the current market could be quite a misleading. If the expectation that the industry’s historically best shipment months were just about to begin the supply side concerns would be greatly diminished.

Global Markets

India has been slow to rebuild a buying pace indicative of growth. The sub-continent is now -22% YTD. Expectations are that suppressed prices, logistical stagnation and an early festival season will bring buyers back into this market.

China imported -16 million pounds less this December than last and is now off -33.6 million pounds on the year pacing -29% with both inshell and kernel imports are down. Logistical issues seem to be impacting the market more so than perhaps buyers may have anticipated with transit delays becoming extended. Interest from China has seen a marked increase in just the last few weeks with any lingering oversupply clearly no longer an issue and prompt shipments harder to come by.

Western Europe has seen a -24% on the year. The largest five markets of Spain, Germany, Italy, Netherlands and UK have collectively imported -58 million fewer pounds on the crop year and the pace at which they are buying has continued to be suppressed. This decrease in importations is likely being offset in large part by increases in production in both Spain and Portugal whose proximity offer an economical alternative. Almond consumption in these markets remain strong and accelerated imports over the next few months is anticipated.

Outlook

Prices have continued to soften recently and commitments are accelerating. There had been a belief that early season buying through the transition had over supplied primary markets and there is anticipation of this situation correcting itself with markets having worked through this back log. There is also speculation that traditional buying seasons will continue to shift to account for logistical bottlenecks that do not appear to be easing. Handlers are likely going to continue to feel pressure to move product as the Industry is in an historically undersold position and supply concerns stemming from yield and drought uncertainty have both waned for the time being. However, it plays out, the Industry will need to accelerate its pace of selling. Looking ahead should the industry accelerate shipments and finish off -10% from last year, at a 2.8 billion yield, this puts the industry near an 750 million pound carry forward. This would continue to limit the upside on any upward price movement, especially if drought concerns were further alleviated this winter.