October 2023 Almond Market Report

October’s Position Report indicates that California almond handlers shipped 247.4 million pounds in October. This is an increase of +15.3% YoY and the Industry has now shipped +7.25% more almonds through the first quarter of the crop year than it did a year ago. The industry added just under +251 million pounds of new commitments in October marking a +3% increase over last October. In total, handlers report 677 million pounds of current commitments, down -2.5% YoY.

The Industry added 709 million pounds of crop receipts in October. This pace was +4.5% higher than last year, but not enough to significantly catch up from a delayed and often impeded harvest. On net, the Industry has harvested and processed -19.47% less than at this time last year. As a result, Computed Inventory and Uncommitted inventory figures are both off more than -20% YoY.

Damage Done

Start to finish, mother nature has continually thrown unfavorable conditions at growers. From an exceptionally cool and wet spring during bloom, a wayward hurricane, early season precipitation this fall and significantly constrained budgets from years, it is safe to say it has not been ideal. Now, as harvest and processing continue, growers are starting to realize the impacts of these converging influences.

Insect damage has been widespread and impactful this season. Industry stalwarts and pest control advisors are reporting some of the worst cases of Navel Orange Worm infestations they have ever seen. Poor sanitation over winter was common due to wet conditions and slashed farming budgets. This resulted in instances of mummy nuts across a significant portion of orchards. A high rate of orchard abandonment has also contributed to an excess of habitat for NOW to develop and mature.

There has also been reported sighting of a new-to-California insect, the carpophilus beetle, which is well known for its impact to almond harvests in Australia. Collectively, insect damage has been significant and widespread with handlers reporting high levels of rejects. The impacts are such that some industry experts have been quoted as predicting final yields as low as 2.2 billion pounds. Industry consensus may not yet be that low, but most are comfortable projecting below the 2.6 billion pound figure forecast in July’s Objective Forecast. The question to debate at this point is how much lower?

Market Watch

Export markets grew by +27.7% over last October. On net, exports are up +10.5% for the year. Domestic shipments shrunk YoY by -13% in October. Domestic shipments on net however are effectively flat YoY, off just -0.8%.

India imported over 48 million pounds of almonds in October, improving over last October by +48%. Through the first quarter of the crop year, India has imported +38% more than it did a year ago. The Sub-continent has already imported more than a third of the total volume it imported in all of the 2022/23 crop year. This heavy buying has been expected coming off of a transition with minimal inventory available and a delayed harvest.

With the festive season growing nearer, one might expect the exceptional pace of buying to slow in India. However our sales team and annecdotes from other handlers indicate that India is continuing to come to the table with interest to buy. In-market contacts have indicated that at these prices almond consumption has continued to be strong and buyers are not as covered as the large import volume might originally suggest. This points to continued strength from the India market and we're optimistic that India will be a leader in consumption growth once again.

China imported 24.3 million pounds in October. This was similar to last October, though fell short by about -1 million pounds. Through the first three months, China is off -23% from a year ago. This shortfall is observed particularly within inshell, with China importing -48% less inshell product through the first quarter than it did a year ago, while kernel shipments are up +44%. It’s likely that the pace of inshell shipments has been slowed by the late harvest and handlers being cautious about overextending the preferred varieties of Chinese inshell buyers. As the processing of harvest continues, we anticipate increases in inshell volume to accelerate shipments to China.

Western Europe surpassed its October shipment figures from a year ago by +22.5%. On the crop year, the region is up +12%. The EU’s largest market, Spain, remains down -10% on the crop year, but did beat its previous October figure by almost +10%. Other top markets in the region however continue to show strong growth. The Netherlands, Western Europe’s 3rd largest market, is currently up +50% YoY, and the UK has reclaimed its title as the region’s 5th largest market and is up +77% for the crop year. Italy and Germany are also experiencing growth, improving over last year by +21% and +7% respectively. The region has also experienced a strengthening Euro helping to offset recent price increases and maintain attractive price levels for importers and consumers alike. This could continue to propel shipments to the region.

Middle Eastern markets executed a remarkable turnaround in October. When September’s figures were reported, the region was pacing a -23% growth rate on the crop year having imported -10.6 million pounds less through the first two months than a year ago. In October, the region closed that gap and now boasts a +8% growth rate on the crop year. The top three markets in the region all imported significantly more volume in October than a year ago. The UAE imported over 19 million pounds, up nearly +9 million pounds YoY, in October. Turkey also nearly doubled its import rate from a year ago topping 13.4 million pounds imported in October.

Seeing such a return to buying in the region is a positive sign for these markets that enjoyed significant growth last year. With shipments rebounding as they did, its reasonable to speculate that the early season shipment slowdown was more a response to a delayed harvest and Handlers needing to process receipts to provide the quality that the region prefers. The region also appears uncovered for Ramadan and buyers will be looking for volume in November and December in order to be prepared for the spring festivities. Look for solid shipment figures through the end of the calendar year.

North Africa continues to see growth as well, but this time not from Morocco. Morocco in fact is off -16% on the crop year. Libya however imported over 3.5 million pounds in October where a year about October shipments barely topped 300 thousand. Libya has now imported nearly 5.8 million pounds and is up +387% on the crop year. Something to watch, if nothing else.

On the Rise

Commodity prices continued to climb off of their recent lows seen at the end of July. Handlers have continued to be cautious about overextending commitments with the uncertainties through harvest and the likelihood of a smaller than predicted crop becoming all the more likely. Whether by choice or by circumstance, buyers have been buying hand-to-mouth with new commitments simply keeping pace with shipments.

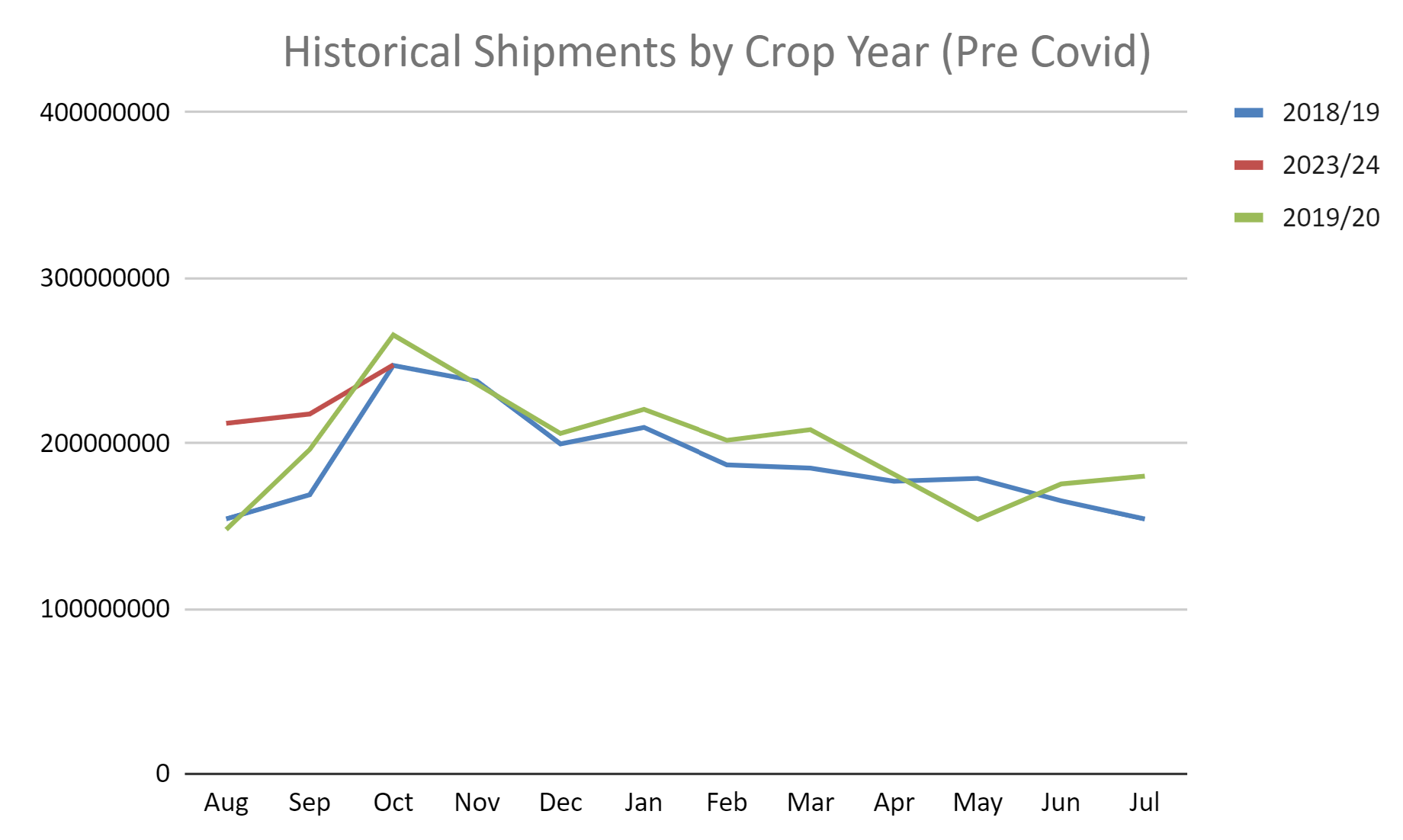

Shipments through the first three months haven’t broken any records, but they do fall in line with our narrative that buying patterns have largely returned to pre-pandemic buying patterns. Consider the following chart that graphs the two crop years prior to pandemic impacts along with the first three months on the current crop year. The lines share similarities.

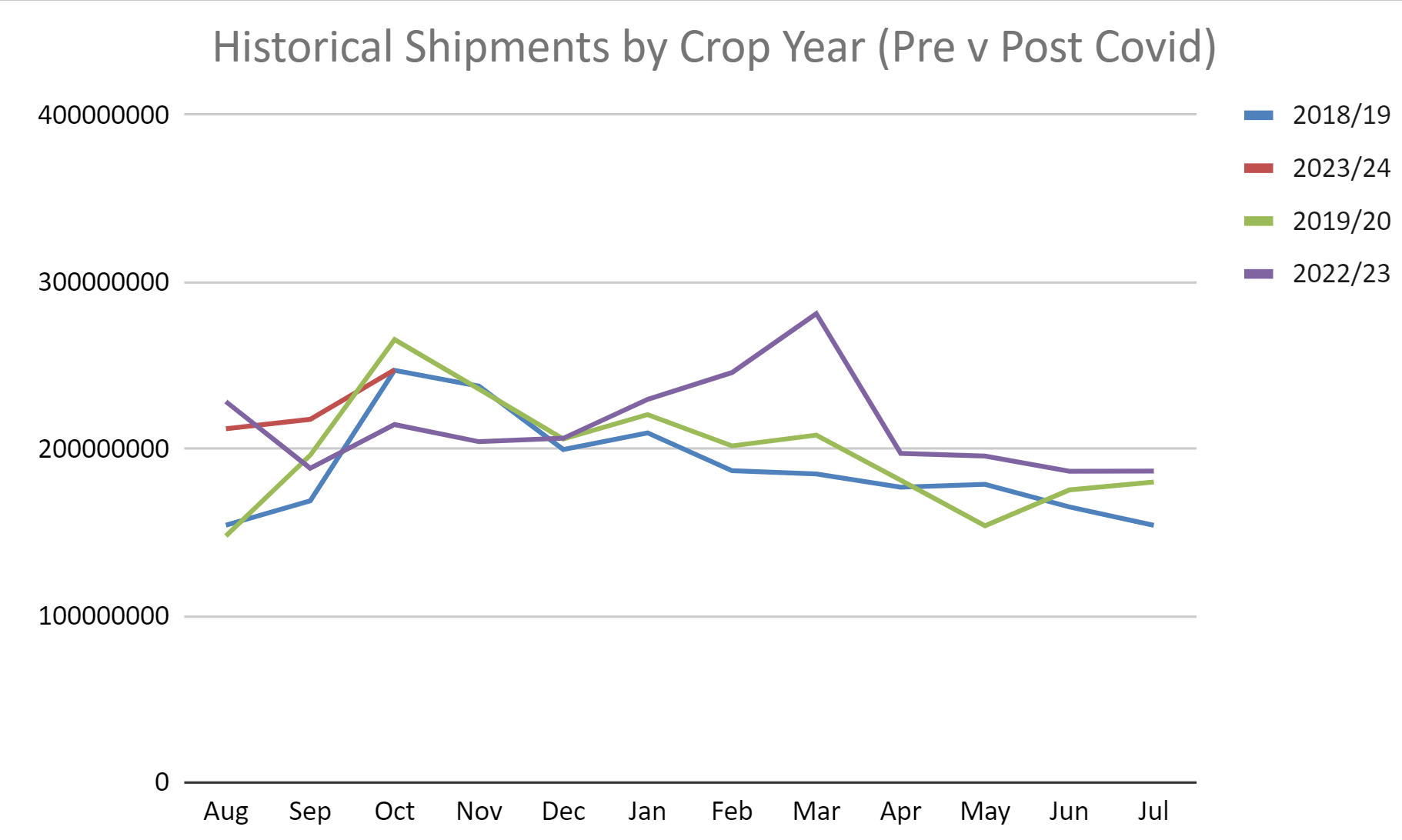

This chart could therefore suggest that a better comparison for shipment trends and projected growth would be these pre-impact years rather than something more recent. The current Position Report shows shipment growth through the first three months at 7.25% This would project shipments of 2.75 billion pounds for the year. But as you can see in the chart below, last year’s shipment cycle continued to enjoy what was a traditionally off-cycle shipment spike. Such a trend seems unlikely this year if you buy into the narrative that buying cycles have normalized.

So if instead one were to average the pre-pandemic shipment figures and compare the current year’s figures, the growth rate would be 9%, but on a smaller base of around 2.3 billion. Thus a projection around 2.5-2.55 billion would be the result.

In either case, the fact remains that the Industry will need to target a July carry forward less than 500 million pounds to return to balance. Whether that balance is achieved through accelerated shipments or suppressed supply is yet to be seen. As supply becomes clearer over the next couple of months, both buyers and sellers will be working to balance demand. For now the shipment figures are pointing to strong demand and questions linger on supply. The hand to mouth buying pattern is likely to cause pressure in specification that are difficult to source, which could very well include high spec SSR/Supreme grades with the high level of serious damage being reported. With extra processing times needed to make these grades, prices may continue to see upward pressure in the short term.