May 2023 Almond Market Report

The Position We’re In

The May Position Report indicated that California almond handlers shipped 195.7 million pounds in May. This figure was -24% behind last May on net with export markets off -27.2% and domestic shipping falling -14.3% YoY. On the crop year, total shipments are effectively equal to that of last year, up just +0.25%. Export shipments for the crop year remain in positive territory currently pacing +3.24%. Domestic shipments have fallen -6.92% through May.

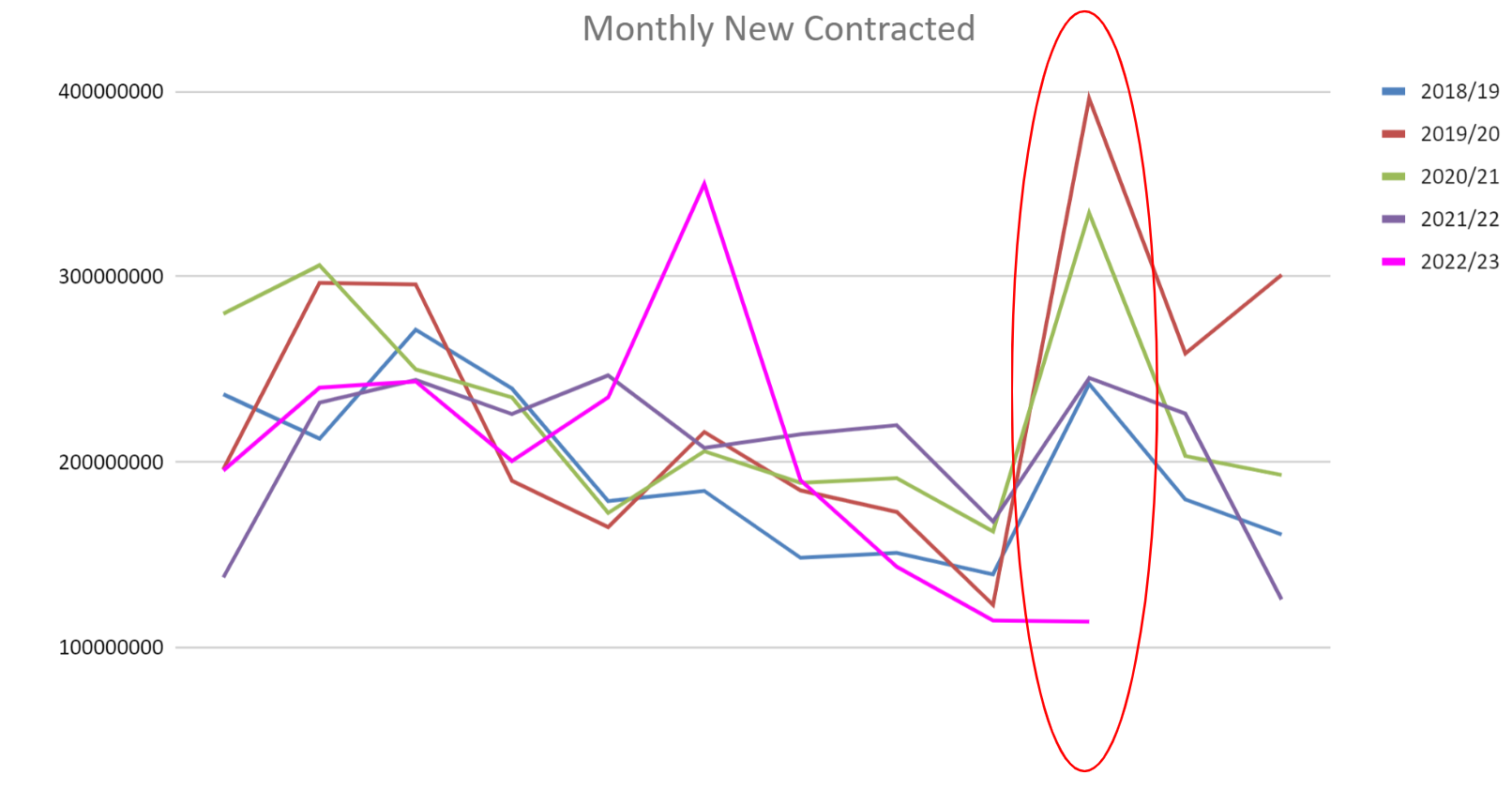

In May, handlers added just under 114 million pounds in new commitments for the 2022/23 crop. This is -53.6% below the new commitment figure for the month of May from a year ago and marks the slowest such rate since April 2017/18. Total uncommitted inventory is just +2.64% above last year in spite of the slower pace of new commitments. Export markets seem to be the primary driver of slower commitment figures, as these markets have -36.49% less on the books for 2022/23 crop year than they did a year ago.

It also needs to be observed that forward commitments for the 2023/24 crop are also lagging by a significant margin over last year. The Industry has reported 57.4 million pounds of committed shipments for 2023/24. Note that May is the first month forward crop commitments are reported in the Position Report, so it is inaccurate to attribute any slowdown specifically to the May time period; but, the figure reported is -55.3% behind last year. When you combine the current crop year and future crop year newly reported commitments, the difference between this year and last is quite stark as the chart below helps illustrate:

New commitments have been falling behind last year’s pace for several months. Some of that could be attributed to the strong pace observed in January, but we have also been reporting that handlers had pulled back from the market when spring bloom conditions were poor. This has surely influenced commitments for the 2023/24 crop as well.

Export Snapshot

Shipments to China remain ahead +19% on the crop year; however, import patterns have begun to shift. China imported -11.8% less on net than it did last May. China continued its recent trend with inshell purchases above last May. Inshell shipments are up +21.1% YoY. That said, inshell shipments were up over +78.6% YoY in April and on net total shipments to China fell -43.7% MoM from April to May. There is still optimism to be had in this market, but it appears some variation in shipment pace could continue into the summer.

Shipments to India in May were behind -41.8% YoY with imports coming in -14.2 million pounds less than a year ago. India now lags behind last year on net for the crop year by -3% after pacing +2% a month ago and +6% in March. But monthly importation rates this year have been variable compared to a year ago and India’s net purchasing pace on the crop year has been both above and below its comparison to last year. The recent fall in shipment figures however is largely been influenced by a lack of ample inventory on the part of California handlers. As such, the softening of shipment rates observed over the past two months is likely to continue to underwhelm. That said, with a delay in harvest expected, much of the tonnage to support Diwali will need to come from the current crop. This could inflate prices for what inventory remains through the transition and any shipments that could be readied promptly after harvest.

Shipments to Western Europe continued to slow in May. On net the region was down -25.9% YoY in May and has slumped to a -7% pace on the crop year. The three largest markets of Spain, Germany and the Netherlands all declined by at least -31% YoY with Spain declining -31.2%, and Germany and the Netherlands off -32.3% and -31.5% respectively. Spain is now -10% on the crop year after seeing declines of -61.2% YoY in April and -29% YoY in March. Germany had been a relative bright spot in the region holding a +6% growth rate on the crop year in April, but slipping to just +1% in May. Italy and France, who round out the top 5 Western European markets, fared better by comparison with both countries seeing relatively flat import figures YoY. With a late harvest expected, confectioner buyers will need to look to the current crop to be prepared for holiday production. To what extent the region is operating hand to mouth could influence prices if the region isn't yet covered.

The buying frenzy may be over in the Middle East. May’s shipment figures were -57.9% below those last year and follows an April figure that itself was -46.6% behind YoY. The region is still up +23% on the crop year and has topped 246 million pounds thus far. You can compare that to 261 million pounds imported in Northeast Asia which includes China or perhaps South Central Asia which includes India having imported 313 million pounds. Both are significant markets and speaks to the growth this region has experienced this year even with slowing figures observed recently.

The region has largely been driven by the UAE and Turkey that are up +14% and +21% on the crop year respectively. Both have seen growth on sizable bases with the UAE surpassing 112 million pounds imported on the crop year and Turkey nearing 68 million. However both have seen significant slowdowns compared to last year over the past two months. After seeing a YoY decline of -63.8% in April, the UAE saw a decline of -82% in May falling over -12 million pounds below the monthly import figure from a year ago. Turkey has seen shipments fall -44% in April and -45% in May. Saudi Arabia and Jordan were effectively flat YoY, while Israel slipped -33.9% in May, however on smaller base. While the pace of buying has cooled, consumers in the region are familiar with almonds and current prices should support continued growth in the region.

North Africa has now topped 82.6 million pounds on the crop year and is up +91% on the crop year. The region has been lead by Morocco which is up +110% on the crop year with 54.6 million pounds in imports. Algeria and Libya are both enjoying significant growth this year as well with both countries having imported at least 11 million pounds each on the crop year. Algeria has a +60% growth rate on the year and Libya is pacing +143%. Like most export markets, the region slowed MoM from April to May but could continue to see strength moving forward.

Market Overview

After a wet and cold start to the growing seasoning, weather has been generally mild. Aside from an occasional isolated thunderstorm and a brief stint of above average temperatures, May brought near-ideal growing conditions across the state. Growers have been able to catch up on orchard activities that had been delayed with the wet start and most growers have been reporting healthy crop development. Kernels have largely solidified with many growers noting that many varieties seem to be progressing on a similar timeline which is supported by the condensing of bloom with many varieties overlapping during brief intermissions in the rain and cold. Growers are still projecting a delay to the front end of harvest, but once it begins the sequence of varieties coming to bear could occur right on top of each other.

With the Subjective Forecast coming above many grower’s expectations and shipment figures slowing in April, almond commodity prices softened during May. It should be reiterated that the forecast of 2.5 billion pounds is still below last year’s figure, but oversupply conditions from the previous two years is still fresh in the minds of both buyers and sellers. Handlers had pulled back from markets ahead of the forecast being concerned of having sufficient inventory to cover transition and forward commitments should the pending crop be both short and late. Some concern for this scenario is still present, but with shipments coming off of their peaks in March and new commitments continuing to be slow, it is reasonable to wonder which side of the supply and demand equation is playing chicken with the other.

The Industry isn’t likely to see shipment figures on par with last year to round out the crop year, but an average for July and August near 200 million pounds per month isn’t all that unreasonable either. At such a pace the Industry would obtain a carry forward of about 760 million pounds (Computed Inventory - (200 million x 2 months)). 800 million pounds is perhaps a more reasonable target considering where we are in the demand cycle, which would be on par, or slightly behind, the 836 million pounds we brought into the current year. This is likely comfortable for many handlers where the expectation is new harvest will be several weeks delayed providing a longer runway to utilize carry forward supply. But in either case, this would imply that overall supply would be comparable to what we saw this year. This puts a functional cap on future demand growth which will give pause to aggressive pricing for new business.

With supply coming into balance with demand, Handlers are likely going to continue to be cautious regarding overextending commitments into the new crop year. Concerns about eventual yield still remain after the Subjective Forecast. Orchard removals are continuing to accelerate fueled by years of orchard stress from drought and stubbornly low commodity prices. There has been speculation that the acreage numbers used for the Subjective Forecast are overstated. There have also been observations of high rates of tree death in orchards where overly saturated soils continued to impact trees that had also been previously stressed. The general sentiment is that there remains more risk of the crop falling measurably shorter than forecast than exceeding it. The Objective Forecast scheduled for July should help put these concerns in context.

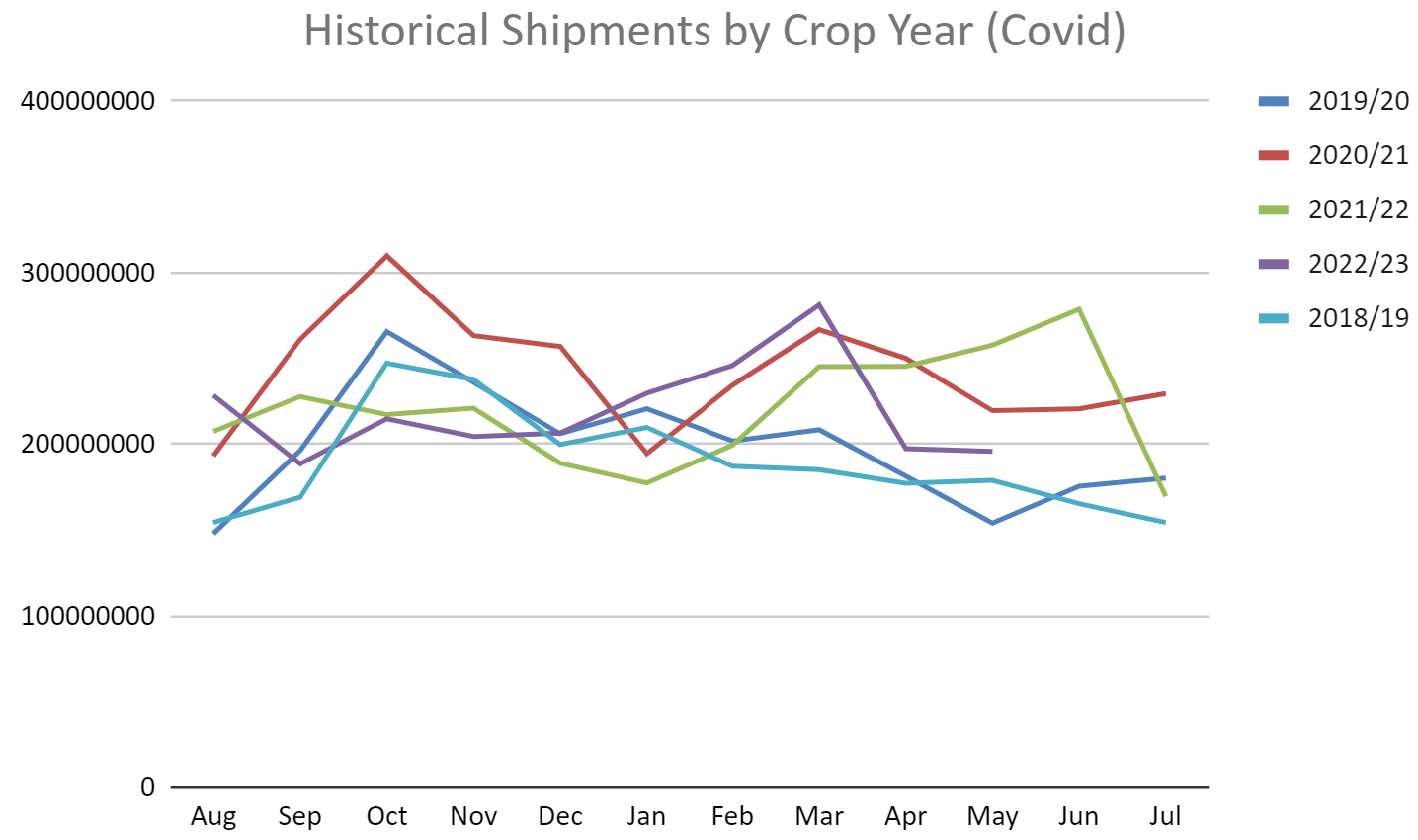

Are we returning to a ‘normal’ demand curve is another question that needs to be asked. We have periodically asked this year in these reports and frequent readers will recall our observations of shipment peaks having shifted in reaction to the disruptions brought on by Covid. However traditionally April - July are the slowest shipment months of the crop year so if we are returning to historical trends, strong shipment months wouldn't be expected to round out the crop year. We did see demand peak in March. This peak does generally follow trends seen in Covid-impacted years. However this peak occurred earlier than it did last year and has tapered off much more quickly. While purely speculation, this peak in shipments may be a false peak and more of a rebalancing of inventories at that time. We are also observing more willingness from buyers to go hand to mouth than during the pandemic. This might suggest that the concerns over supply chain disruptions observed during the pandemic have in fact subsided. If we see shipment figures continue to slump through the summer, don’t be surprised if a return of the Fall demand peaks we used to see reappear.

What will be interesting to watch between now and then is who flinches first in the game of chicken that handlers and buyers seem to be playing with each other. The shipment figures, while below last year, are well within Industry expectation. A gap in new commitments is also something to be expected with handlers having pulled back in recent months. While the forecast didn't come as low as some had thought, sentiment remains that it may be overstated. At the very least, the delayed crop will mean Europe and India will need to cover a significant portion of holiday needs from the current crop. Handlers know that buyers will need to come to the table and seem accepting of a wait and see approach without the fear of a glut of almonds after harvest.

And this approach may be having an impact. While prices fell during May, a rebounding took hold during the past week. Reports have also been heard of large buyers looking to cover the transition and paying a premium for new crop. Which side of the equation is going to have the bigger influence on the other? For now they are in balance and we might not see much indication with price movements, but again, this could change come fall.