March 2023 Almond Market Update

Bright Shipments

March’s Position Report shows that almond handlers shipped over 281 million pounds of almonds in March on net. This is the second largest single monthly shipment number on record behind October 20/21 crop year where 309 million pounds were shipped. It also surpasses last March by +14.7%. Total shipments on the crop year have now approached 1.8 billion pounds, which is +6.85% ahead of this time last year.

Supply Side Constrictions

Computed Inventory, which accounts for carryover, marketable crop receipts minus shipments sits at 1.5 billion pounds. This is behind last year’s figure at this time by -13.58%. While committed shipments lags behind last year’s figure by over -22%, the uncommitted inventory figure remains below last year’s mark by -5.89%. This indicates that the Industry has both less to sell moving forward with less on the books than it did a year ago. With just a third of the crop year left to go, this reality has quickly changed the supply-side conversation from an oversupply scenario to one where supply tightening has rapidly developed and continues to constrict.

Consider this forward-looking scenario: assume the Industry continues its growth rate of +6.85%. Total shipments for the year would project around 2.7 billion pounds. Factoring total supply for the current crop year, carryforward would dwindle to 500 million pounds. This growth rate may be overly optimistic, so if instead the Industry simply shipped what it did last year through the end of the crop year the Industry project roughly 575 million pounds as a carry forward. We’re projecting closer to a 600-700 million pound carry forward, but anything at this point is still nothing more than a loose forecast.

Quick math will show you 500-550 million pounds is slightly below, but more or less in the ballpark. . What is important from the exercise above isn't the finite number itself, but as a percentage of annual shipments. We have observed that price stability generally occurs when the carryforward target is 20% of annual shipments. Too mush below that, prices rise; above that, prices fall. Rough math suggests we are within reach of a stable 20% scenario where supply is in balance, at least for the current crop year. This does suggest that future crop expectations could have profound influence on commodity prices as crop conditions become clearer should they swing significantly one way or another.

Weather has also brought significant uncertainties to the market, particularly concerning the strength of the next crop. Pollination was wet and cold and these conditions have generally persisted thus far through the season. Handlers had completely left the market in mid February and have only recently reentered having been so concerned with pollination viability. A clearer understanding of how severe the weather impacts will begin to materialize next month with the publication of the subjective forecast, but for now, significant concerns remain regarding future yields. See ‘Weather, Pros and Cons’ for more information regarding weather impacts.

Another interesting indicator of possible supply constrictions is the volume of Inter Handler Transfers. March transfers were +228% of the rate a year ago and are now effectively double on net for the year. Such volume suggests that handlers have significant gaps in their individual positions to cover needs and have been shifting inventory between themselves to better cover their needs. Markets should expect that some varieties, sizes and grades may be in shorter supply than currently thought and may yet see additional price discrepancies arise as these shortfalls come into focus.

Hot Export Markets

Export markets grew +24% over last March and are now ahead of last year at this time by +12.44%. Export markets set a new monthly record for the third consecutive month in March and the fourth time this year. Domestic markets on the other hand are off -5.75% YoY and represent the smallest shipment numbers through March since the 2017/18 crop year. Shipments on net however are up, and export markets are to thank.

China imported over 24 million pounds in March surpassing last year by +275%. This shipment figure is so large that it accounts for more than 20% of net shipments currently on the books for the entire crop year. China has moved to an annual growth trajectory of +19% when it had been even just a month before. Both kernels and inshell products are showing growth. Overall growth is still weighted towards kernels which are up +55.5%, while inshell paces +3.8%.

India imported 27.5 million pounds in March, up 15% YoY. India currently paces a growth rate of +6% having already imported over 251.5 million pounds on the crop year. This is a market that has seen significant quickening of its pace of buying after the early Diwali season and appears likely to remain strong moving forward. Looking forward to the summer transition, an expected delay in harvest could put pressure on the sub-continent to adequately supply itself ahead of their next festive season. An overly short crop could begin to significantly move prices if shipments deplete inventories sufficiently enough between now and then.

Western Europe on the whole has slowed a bit in recent months from its strong growth oriented pace of buying earlier in the year. The region is still ahead of last year at this time, but only by a +1% margin. March was a mixed bag for the region’s major markets with Germany and Italy posting +27% and +31.3% growth rates YoY respectively, while Spain and the Netherlands went in the opposite direction with respective growth rates of -29% and -31% in March YoY. Of the current top 5 Western Europe markets, all have positive growth rates on net for the year except the Netherlands which paces -9%. The United Kingdom has itself fallen out of the top 5 by import volume and paces -19% on the crop year. A delay in harvest could also put pressure on the European markets who will need to be purchasing ahead of their holiday season with sufficient time to receive and process the almonds.

The Middle East may well be having an awakening. Through the first 8 months of the crop year the region now paces a +59% growth rate. The region has imported almost +80 million more pounds on net than it did through March of last year. Virtually all markets in the region are seeing growth with all top 5 markets experiencing growth of at least +20%. The UAE has imported over 103 million pounds on the crop year, making it the 4th largest export market behind China at 116.4 million pounds.

Weather, Pros and Cons

In years where winter had been dry, a ‘Miracle March’ would refer to an especially wet March coming to the rescue and saving California from a dry season. California needed no such rescuing this season, but March brought a parade of wet weather nonetheless. The result is that California now sits on a record snowpack, which as of April 9th was reported at 243% of normal Statewide with the Southern Sierra topping an unbelievable 306%. Mammoth Mountain, a popular Ski destination for Los Angeles area residents situated in the southern Sierra just behind Yosemite has announced they expect to remain open through August (closed June 5th last year) after blowing through its previous record and topping 702 inches. For those on the metric system, that’s 17.8 meters!

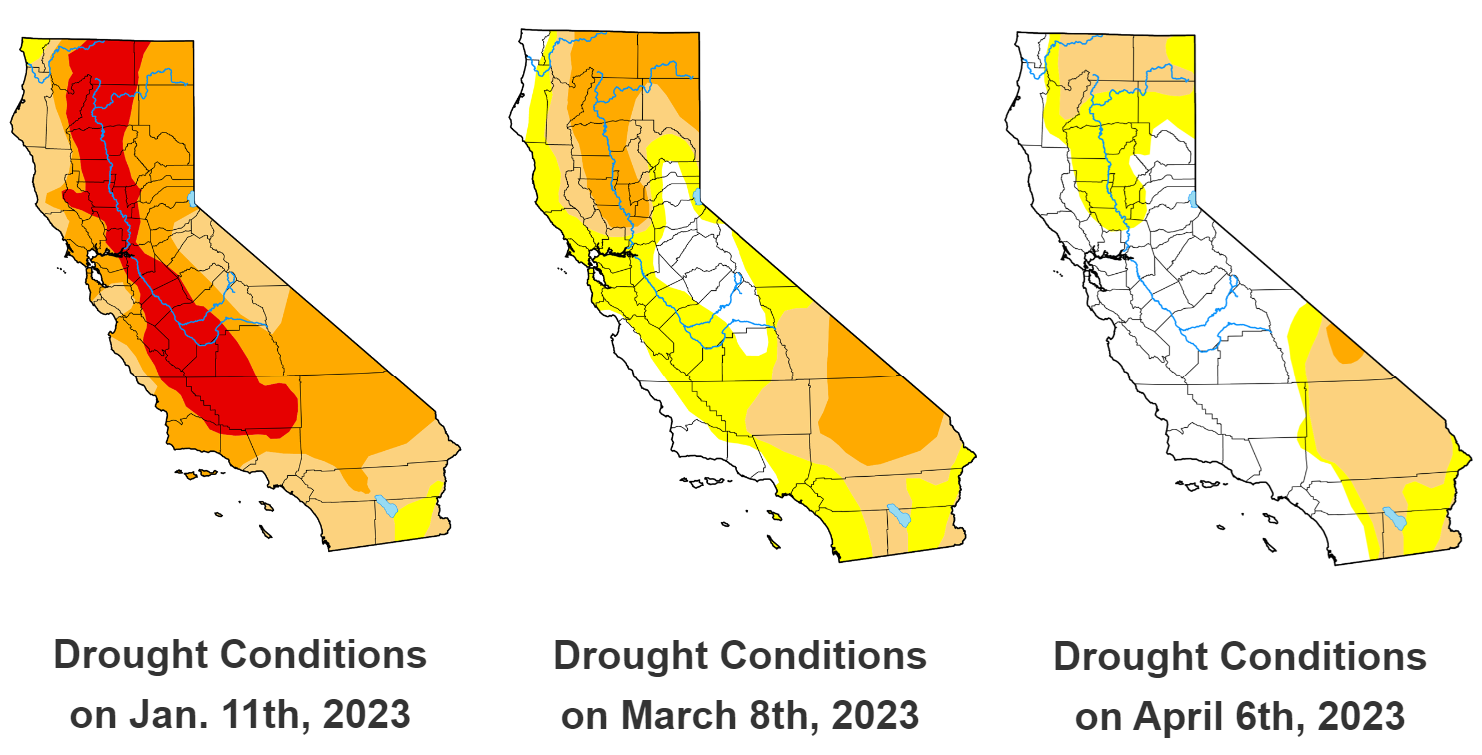

Intuitively, all this precipitation has continued to alleviate drought conditions. All Almond growing regions but the north have officially exited drought with the North progressing to the least severe tier of ‘Abnormally Dry’.

Too much of a good thing can also become a problem and California is seeing this first hand and in dramatic fashion with the reemergence of a long dry lake bed known as Tulare Lake in Kings County in the southern end of the valley. Rivers that once flowed into the lake have long been diverted to fill reservoirs and supply agricultural waters, but reservoirs have been over-burdened and low lying areas have begun to flood. Officials warn that as snow melts flooding in the area could worsen or at least continue with waters expected to remain through the summer.

While the resurrection of a long extinct lake is dramatic, the wet weather is a cause for concern for almond growers across the state. The continual wet weather has had it difficult to access orchards to administer nutrient applications and defend against disease and pest pressures. Reports of yellowing leaves have been persistent as dry fertilization has been difficult to implement and liquid applications not an option with how wet the orchards have been. Nutrient deficiencies are also being exacerbated by budget cuts many growers have implemented in recent years.

Wet weather has also been accompanied by cooler than average temperatures. Modesto saw its 4th coldest March by total temperatures since 1927 according to the Modesto Bee. Cold temperatures have slowed almond development, first delaying bloom, and now continuing to slow initial development. This has made it more difficult to assess how well orchards were pollinated and to what degree almond set looks to have progressed. The delayed development has also sowed the expectation that harvest itself will be delayed possibly pushing back receipts by a couple of weeks.

There is a bright side to all the rain and flooding. Water managers recently approved plans to divert additional waters from the San Joaquin river to agricultural users to flood fields for added ground water recharging. This streamlines a permitting process of a plan that has become a critical concept for ground water management under SGMA regulations but has remained a cumbersome process. Wet years have also historically produced above average ground water basin recharge and there is hope that overly wet soils will also help this year.

Wet fields also delay the demands of water deliveries to agricultural users. This delay could help reservoirs better achieve operational capacity and possibly prolong peak pool, which could have potential benefits next year for reservoir operators with nine of California’s top 10 reservoirs exceeding 100% of their historical averages for this time of year. In fact Oroville (2nd Largest) has already released water over its spillway under flood control operations and Lake Shasta (1st largest) may not be far behind, as it too, has entered flood control protocols and could release over its spillway if lake levels exceed certain levels this spring for just the second time since 1997-98.

Murky Waters

Uncertainties regarding current crop conditions is likely going to influence many handlers to take a cautious selling approach heading into the summer transition period. Current supplies are not so constrained that handlers would pull off entirely, but they are likely to be more selective as they balance forward needs with future supply expectations. We can already see this materializing with few commitments on the books and one of the slowest new commitment paces for March in at least five years. However, there are plenty of indications that demand remains strong. Anecdotal evidence suggests that many handlers had exited the market almost entirely in Mid February when bloom conditions were not favorable with many not reentering until mid March. While new commitments were historically low for March, they remain higher than many expected when accounting for the temporary pull out.

Growth in export markets appears strong as well, and if buyers haven’t positioned themselves with forward contracts or excess on-hand inventory they will need to continue to come to the table if they are going to meet market demand. If they are overly exposed, strong demand pressures will only continue to inflate commodity prices. If buyers can take a break and wait for a while then eyes will be even more focused on the upcoming Subjective Forecast expected in May. In either case, the forecast will help put into perspective the influences on potential yield that the weather has had and begin coalescing expectations on eventual crop.