June 2023 Almond Market Report

Current Position

The June Position Report indicates that California Handlers shipped 186.6 million pounds of almonds in June. This is -33% behind last June and the smallest shipment figure on the crop year. Export shipments saw the largest decline YoY slipping -41.4% from last year while domestic shipments were off -4.8% from a year ago. On the crop year, export shipments are -2.22% off while domestic shipments are off -6.73%. On net, shipments are off -3.51% for the crop year.

219.6 million pounds of new commitments were added in June. This is behind last June by -2.9%. Net current crop commitments are essentially flat YoY (-0.73%), while net new crop commitments are off -48.2%.

Current computed inventory levels (976 million pounds) suggest the industry is targeting a carry forward around 775-825 million pounds should Handlers ship between 150-200 million pounds in July. This would put the industry in roughly the same starting inventory position that it saw last year (836 million pounds).

Objective Forecast

July’s Objective Forecast suggests that California almond growers will produce a crop yielding 2.6 billion pounds during the upcoming harvest this summer. This is +4% higher than the 2.5 billion pounds forecasted by the Subjective Forecast published in May and +1% higher than the 2.57 pounds harvested last year.

The forecast predicts kernel sizes roughly +14% larger on average than last year. The mild early season weather certainly supports the development of larger kernels and helps make up for the lower average nut set that the forecast observes. This is setting up the industry for a nearly identical supply scenario as last year.

The forecast comes in above many growers’ expectations. Record rainfall, prolonged below average temperatures and strong wind events suppressed bee flight hours and created unprecedented bloom conditions. Unlike the frost event last year in the north, theses unfavorable conditions were widespread throughout California and persisted even in the south were weather tends to be more favorable for almonds in general. Industry consensus was in the 2.2-2.5 billion pound range and many industry stalwarts may still stand by this figure, especially with additional skepticism regarding final acreage figures with many observing high rates of orchard removals this year.

Either way it is important to remember that the forecast is better viewed as an estimated range of outcomes, which the report itself reports as 2.24-2.96 million pounds with an 80 percent confidence interval, so even those with a more pessimistic view on crop expectations would be within the realm of statistic accuracy that the forecast projects. For market makers however, the gap between the high and low ends of the forecast are quite significant and should yields fall at either end of that spectrum, markets would surely move accordingly.

We can also examine historical accuracy of the forecast for hints at reliability of the mid point figure that the forecast puts forth annually. Over the past 10 years, yields have averaged within +1.19% of the Objective Forecast. Over a 30-year period, this figure is even smaller at -0.11%. That said, annual figures have varied between +14.22% and -12.15%. Such variability indicates that while on average the forecast is accurate, it rarely hits the true yield on the nose. Again, the way to put this into context is in a similar manner as the forecast itself and look at the standard deviation of these variances to provide a probability range. We can calculate 1.5 standard deviations to represent an 86% confidence level, which is on par with that of the forecast itself, and using a 10 year average, come up with a range of 2.29 - 2.97 billion pounds. This should look rather similar to the predicted range of the forecast itself reinforcing that as a statistical model, the forecast is a robust model. If we use historical numbers instead of the most recent 10 year period, this range is compacted to 2.31 - 2.88 billion pounds.

The issue of course is that industry participants want a more definitive yield target in spite of the volatile nature of agricultural products and the mathematical realities of any statistical model. We simply will not know what the future holds until it arrives. For now, buyers and sellers will have to adjust to the reality that the general market will be expecting something closer to the 2.6 billion pounds that the forecast projects rather than the 2.2-2.5 number that many growers may yet expect.

World Markets

China imported -14.4% less in June than it did a year ago, but remains +17% ahead of last year on net for the crop year. Kernel shipments in June surpassed kernel shipments YoY by +14.1% while inshell shipments we off -76.4% YoY. On net, both inshell and kernel shipments are above last year’s marks with kernels pacing +38.6% and inshell +3.9%. With inshell supply low, China is unlikely to accelerate its inshell purchasing until new crop is available, but kernels should be available to buyers and recent trends would suggest a solid shipment figure again in July.

India again experienced steep declines in its importation of almonds. The region imported -23.4 million pounds fewer inshell almonds than it did a year ago amounting to a -60.9% YoY decline. This comes on the heels of a -41.7% YoY decline in inshell shipments seen in May. India is now pacing -10% annual growth on the crop year with little room to reverse that trend with just a month to go.

While a slowing pace of imports is unwelcome, the dip is assessed as a reality of supply not of shrinking demand. Inshell supplies have long been tight and this can be seen in pricing data indicating that current crop shipments are commanding a premium over future crop. This would occur in scenarios where prompt delivery is required and competition for limited supplies is tighter.

India also received some positive trade news recently with the announcement that retaliatory tariffs on almonds would be removed within the next 90 days. The reduction is welcome news for both buyers and traders as it returns California almonds to a level playing field and makes the commodity cheaper.

Every market in Western Europe has moved to negative growth on the crop year except France which has a +15% growth rate on the year and has continued to surpass the UK for the 5th largest market in the region having now imported over 23.5 million pounds on the year. France however, like all regional markets, was below shipment figures seen a year ago in June and was off -47.8% YoY. Spain was off -55.2% YoY, Germany -39.7% YoY, Netherlands -39.4% YoY and Italy -32.8%. Western Europe on net is pacing -12% on the year heading into the last month of the season.

More on Western Europe in the next section

The Middle East has continued to slow off of its torrid buying pace. The region however is still +11% ahead of where it was last year and several markets continue to pace significant gains for the year. Jordan has topped 21 million pounds in imports this year marking a +51% growth rate, Saudi Arabia, with over 24 million pounds imported, is growing at a +35% pace and Turkey, at 74 million, is growing +15%. All major markets were below their shipment figures from last June with the UAE off over -12 million pounds (-80.1%).

Morocco, having seen significant growth on the year, was another market that saw slowing shipments in June and was off -60.1% YoY. The North African nation is still pacing a significant +65% growth rate on the year having imported over 58 million pounds on the year.

A Case Study for ‘Returning to Normal’: EU

Western Europe is off -12% for the crop year, and for a developed market, this could be an alarming development. However, some historical context may help put the current data into perspective, especially since last year markets were still dealing with large scale logistics impacts from Covid-19 wrought disruptions and comparing this year’s figures where logistic issues have eased significantly may not be the best means of comparison. In essence, the decline the region is seeing may be more a product of when buying is occurring rather than overall demand so a different benchmark that year over year may be warranted.

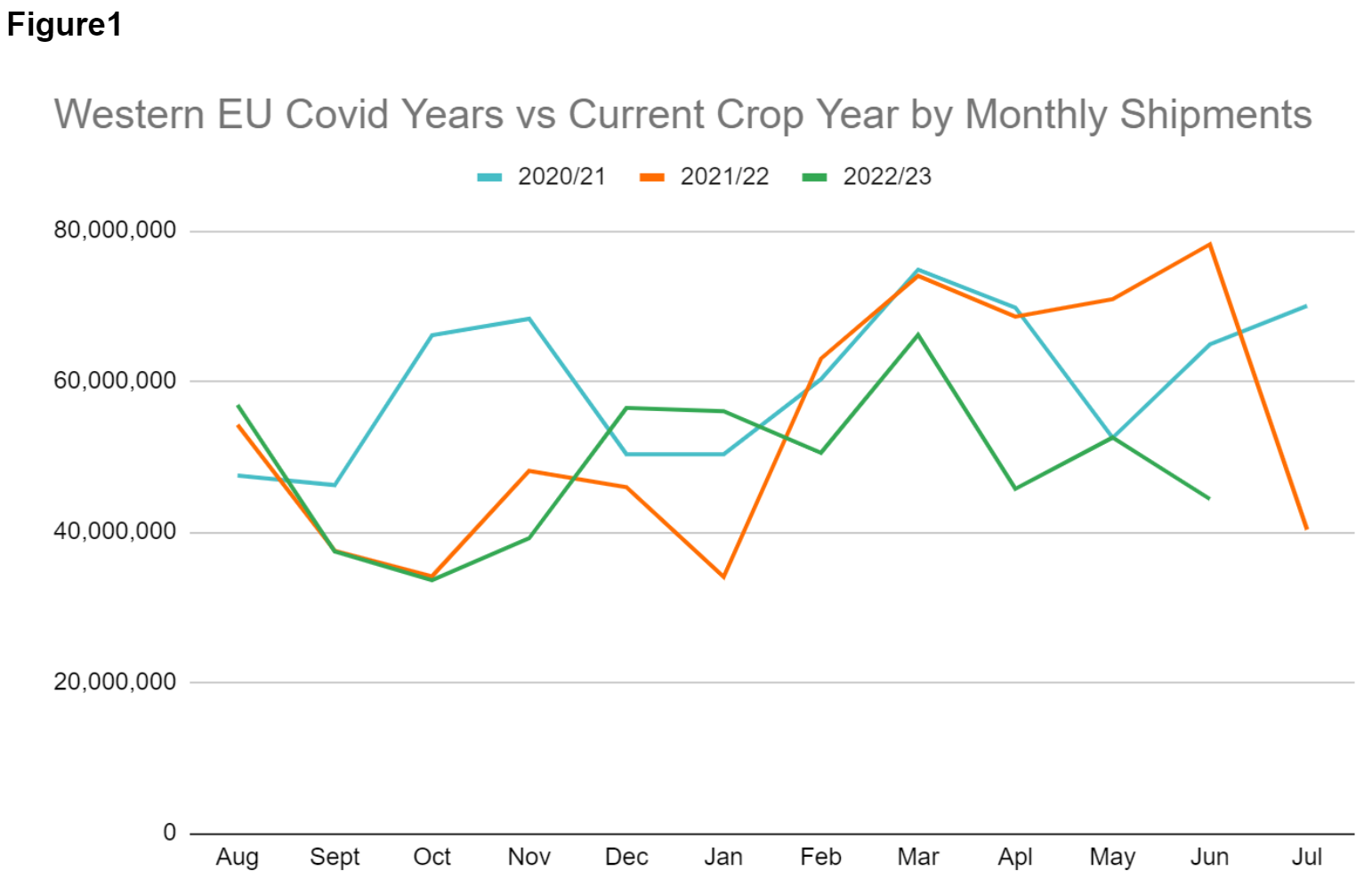

Figure 1 charts the current crop year’s monthly shipments aside monthly shipment figures from the most recent two crop years. These were the Covid impacted years.

A large gap in shipments can be observed between the current crop year shipment figures and that of 2021/22 March forward. This is reflected in the current -12% YoY pace that Western Europe is experiencing. But notice that in the current crop year that neither the historical Oct/Nov spike seen in 2020/21, nor the May/Jun spike we saw in 2021/22 materialized. There was however a spike in March which was consistent over the previous two covid years that replaced the historical Oct/Nov spike. This could support the notion that the region is still in a covid impacted buying cycle, but what if the spike in May/June of 2021/22 was a further adjustment of the Oct/Nov historical spike moving from March closer to the historical time period? And what if the March peak observed this year as a rebalancing rather than an echo of covid impacted trends? If this was the case, one could argue that a May/June spike would not be expected and we should also be able to observe closer similarities between the current crop year and historical pre-covid buying patterns.

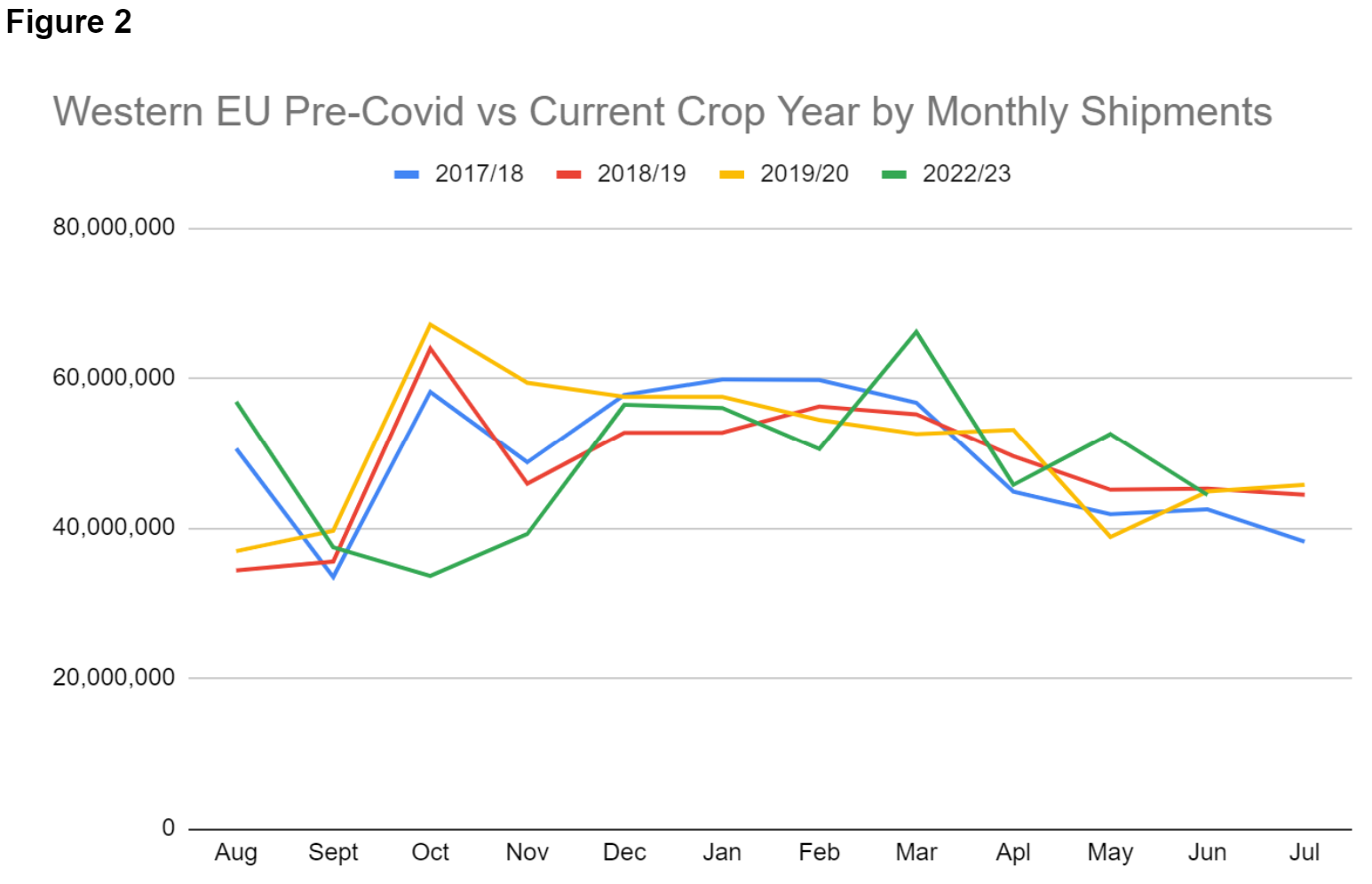

Figure 2 suggests this may well be what we are seeing. It charts pre covid years alongside the current crop year and outside the trough observed in October and perhaps some rebalancing in March and May, the charts look remarkably similar. And considering that Oct/Nov were on the heels of a second shipment spike seen in May/June last year, it is reasonable to assume that the market simply had already made its purchases to cover while they further returned to a normalized buying pattern.

Essentially what has happened is a return to normal has cannibalized the yearly shipment spike making current figures look more sluggish than they really are. We postulated this general returning to normal previously, but not all markets are as ready to normalize as the EU appears to be. We expect shipment figures for the region to continue to follow historical trends more closely than they have with a strong October and November shipment period ahead.

What is Ahead

If a return to historical shipment trends is indeed materializing, the next big shipment period will not occur until October. Inshell markets like India and China are likely going to be pushing for shipments as early as possible and prompt shipments are likely to command a premium as harvest begins.

Handlers had been trading on an expectation of a smaller crop size than what the Objective Forecast predicts and thus may be more willing to take forward contracts than they have been. This may help continue to suppress prices in the short term. That said, a larger forecast sets up the industry for a similar marketable supply to last year leaving little room for demand growth.

It should also be reiterated that in the case of Europe, and other markets returning to a normalized buying cycle, that by this time next year, measurable year over year growth is likely already built in. As observed in the charts examining the EU, the annual peak that was shifted earlier in the season during covid seems to have shifted back in such a way that a shipment peak did not occur this year as it normally would, essentially creating a year without a demand peak. This would imply that last year’s shipment figures were artificially deflated as shipment cycles shifted back to normal and would need to grow to rebalance. This will be an important factor to watch, because should this trend materialize and do so across several markets, shipment increases would happen naturally and already be baked into the market. This could impact prices in the back half of the season when this shipment growth runs into the reality that growth hasn’t occurred on the supply side of the equation. This is speculative of course, but something worth keeping an eye on as the new season takes shape, especially if grower wisdom has any truth in their worry of a shorter crop.