July 2023 Almond Market Report

Year End Position

The July shipment period ended the 2022/23 crop year. The July Position Report indicates that California handlers shipped over 186 million pounds in July, exceeding last July by +10.2%. Total shipped for the year topped 2.56 billion pounds, falling -2.63% behind last year’s annual shipment figure. Handlers hold about 792 million pounds, which is -5.47% below the carry forward a year ago. This carry forward is in line with recent market expectations and provides ample inventory to supply the Industry through the transition period as new crop is being harvested; however, the Industry is better in balance when carry forward is roughly 20% of shipments and it’s currently closer to 31%. This will help continue the oversupply sentiment at least for the short term.

The Position Report also shows that commitments for current crop exceed last year’s figure by +7.1% closing in on 373 million pounds. New crop commitments however lag by over -93 million pounds from a year ago, off -31.3%. Combined, commitments are off -10.6% YoY. That said, newly reported commitments in July were over 191 million pounds, representing a +51,7% increase over last July and now show momentum with June figures signaling a turn around in sluggish commitment figures observed over much of the spring.

Annual Market Performance

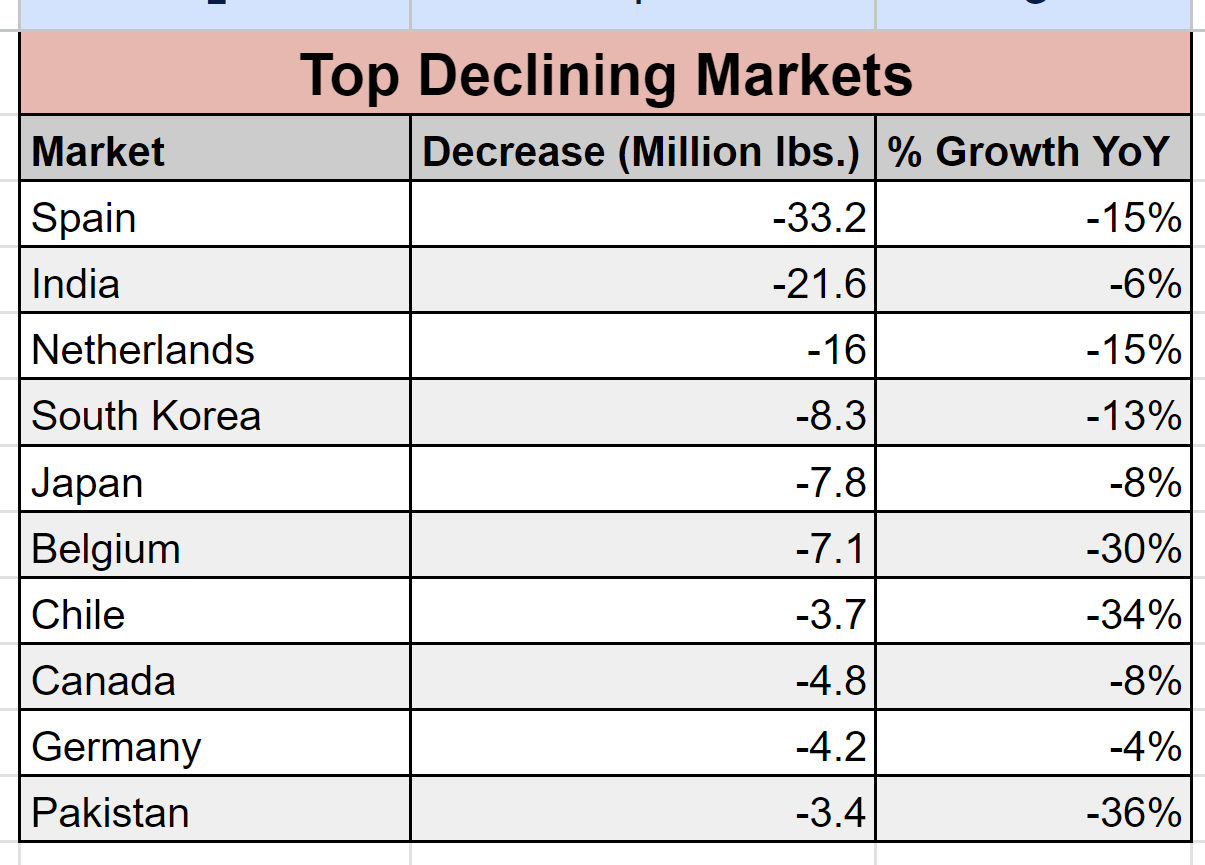

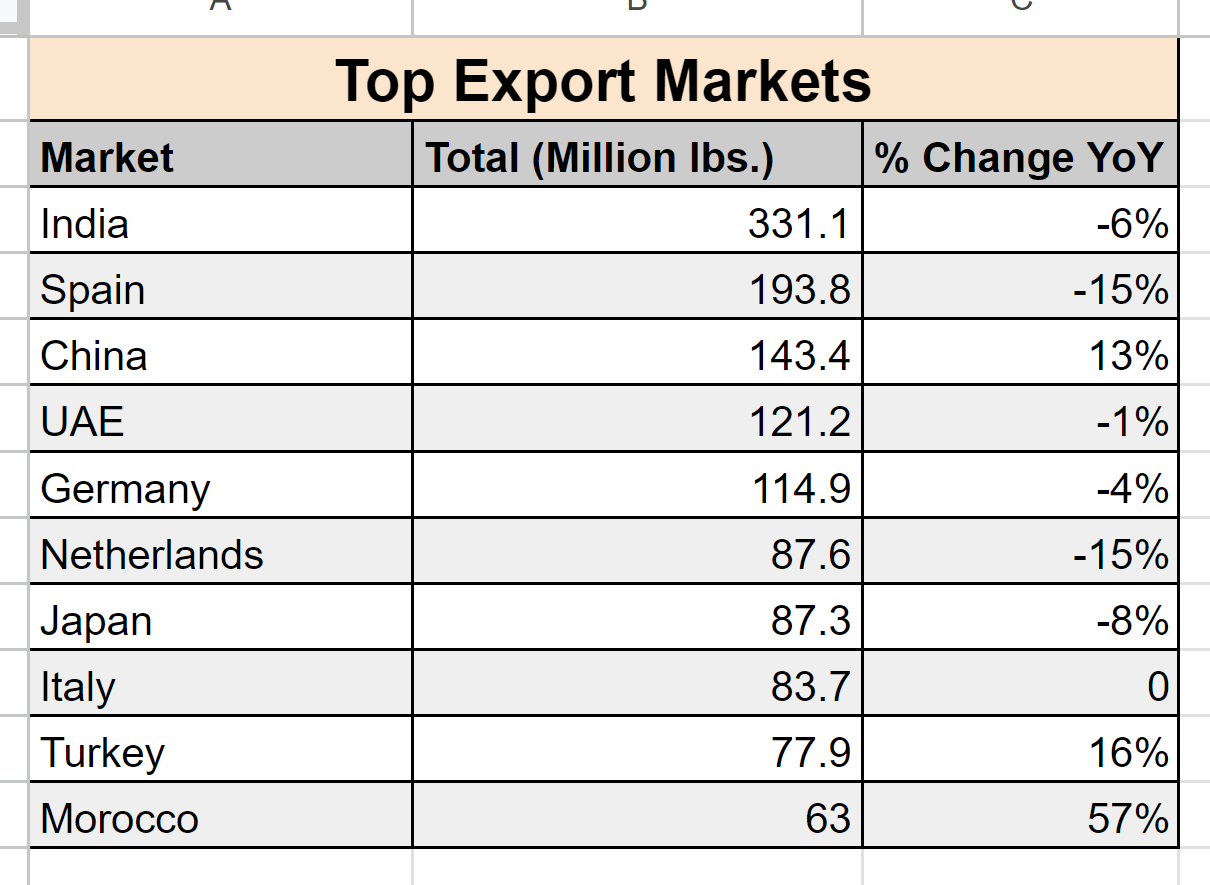

The majority of top export markets saw a decline YoY in shipment volume with Spain and India combining for -54.8 million pounds less YoY. This is nearly equal to the sum of the next eight largest YoY single market declines combined (-55.3 million pounds).

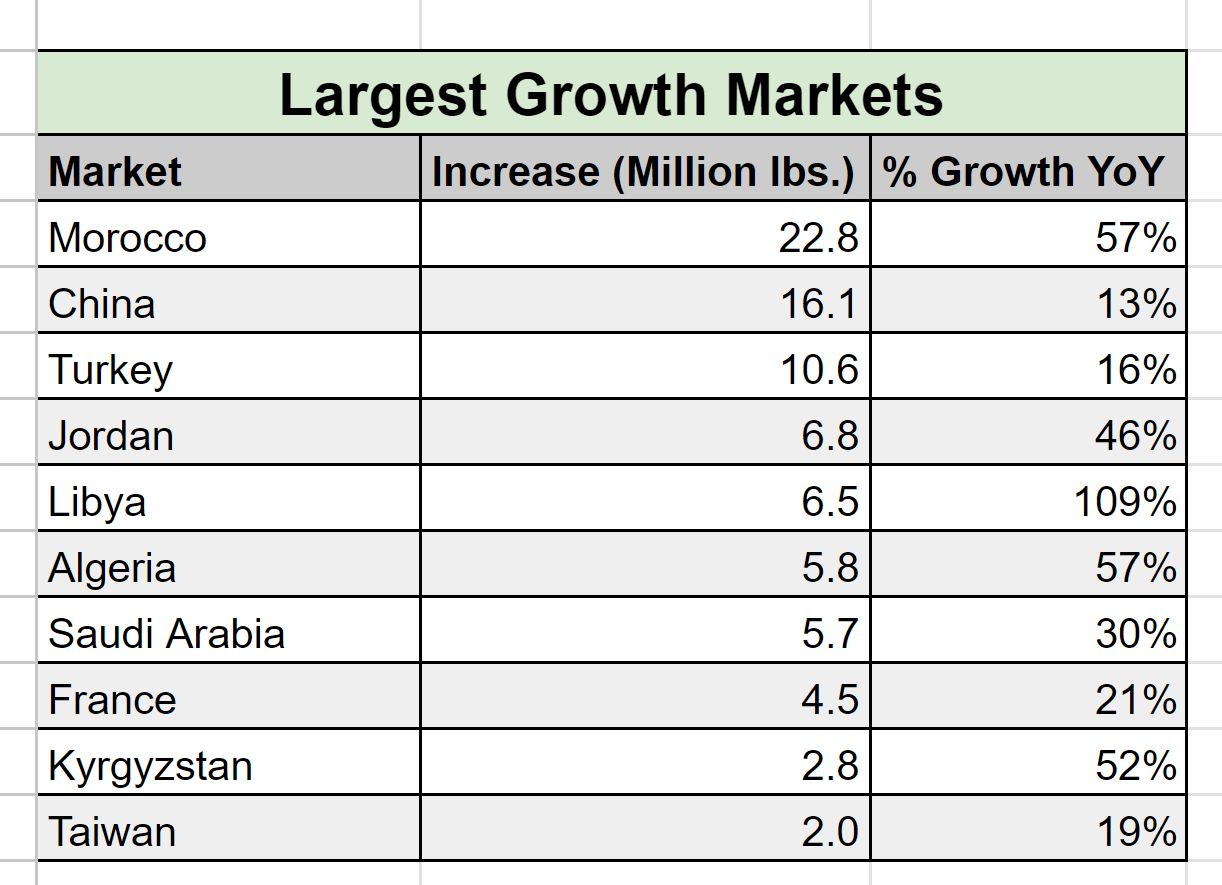

Morocco topped all growth markets adding +22.8 million more pounds to imports than a year ago and is now the 10th largest export market, surpassing South Korea and Canada as last year’s 10th and 11th largest markets respectively.

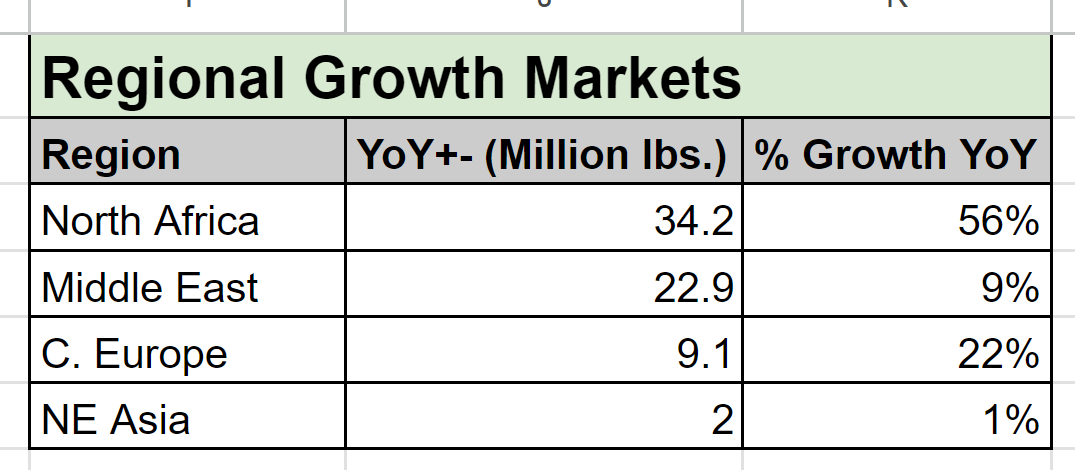

Three countries from both the Middle East and North Africa are among the top 10 largest growth markets. They include Turkey, Jordan, and Saudi Arabia from the Middle East; and Morocco, Libya, and Algeria from North Africa.

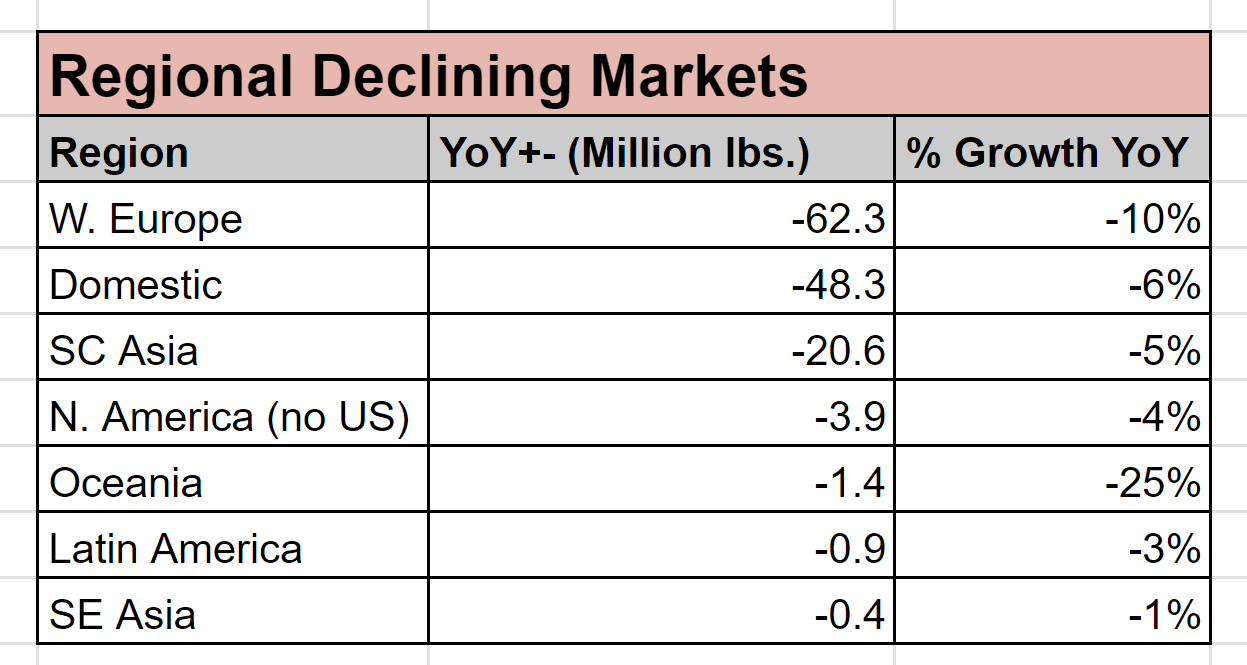

Four markets from Western Europe make the list of top-10 declining markets. This includes Spain, The Netherlands, Belgium and Germany. France does make the top-10 growth list, but on the whole, Western Europe saw significant YoY declines (-10%)

Region-level growth from North Africa and the Middle East should not be surprising considering the frequency of which markets from these regions appeared on the list of top-10 growth markets. N.E. Asia does show growth as a region, but the relative strength of China is being offset by weakness in South Korea and Japan, which are ranked 4th and 5th as declining markets.

Western Europe leads all declining regions and is off over -62 million pounds. We did postulate last month that this region may have seen shipments slow as a result of buying patterns returning to pre-pandemic cycles. We welcome you to revisit our previous publication and will be watching this region for shipment levels to pick back up as we approach historical buying peak periods of September through November. This upcoming period will tell us a lot of the health of the region.

Domestic shipments were also off on the crop year by -6.3% YoY. The 716 million pounds shipped is the smallest figure since the 2016/17 season that saw 676 million pounds shipped. Almonds are still trending top of mind in many key consumer sentiment reports, but we will continue to monitor data to understand if the dip in demand is being fueled by fewer new product developments, inflationary pull back, and/or changes in consumer behavior.

Harvest

Harvest has begun in many fields across the state as the early varieties reach maturity. It is far too early to assess much of anything with any certainty; but, there is still sentiment among growers that harvest could fall below the Objective Forecast of 2.6 billion pounds with some holding firm at an expectation of 2.2 billion pounds. The weather has been generally average this growing season, with the exception of bloom. Most regions have seen significantly fewer days exceeding 100 degrees Fahrenheit (38c) than we’ve seen in recent years. With plenty of water being available this year and a mild maturing season, it’s reasonable to expect larger kernel sizes than we’ve seen the past few years. Initial reports suggest this will be the case, but we will continue to monitor as we begin processing.

General Market Conditions

Almond prices on the whole have softened of late and continue to come off their recent highs that peaked in May. With carry forward coming in near 800 million pounds and an acceleration observed in new commitments, it is clear that it is currently a buyer’s market. How long handlers will be willing to continue selling at these levels may depend on a few things.

As initial receipts come in, the first real data will be on hand to project eventual yields. There will be a lot of attention given to how well the forecast may be aligned with these initial yields. Overall supply will be an important market driver. Assuming a 2.6 billion yield, the Industry could accommodate about +10% growth while targeting a comfortable carry forward next year; but, that capacity would quickly dry up if eventual yields fell much below projections.

Sentiment also suggest that supply lines have less inventory available than in recent times, especially in export markets. There is also reason to believe that September through November could look more like the shipment patterns seen pre-pandemic and observations of dry pipelines only fuels this belief. If the Industry continues to shift back to these historical patterns, there could be real volume that will need to hit the books and make its way through packer facilities simply to accommodate general demand in the short term.

India also seems likely to be looking to buy heavily in the near-term. Shipments slow downs over the past few months have been in large part due to a lack of supply and buyers in the region could be looking to quickly replenish. If India buys aggressively to replenish inventory, this too could push packers into a bottleneck scenario logistically. Further out, India also looks poised to fuel export growth. The Rupee has become relatively stable against the dollar, the government remains focused on domestic investments and creating jobs for its largely young workforce, and it was polled as having a 0% chance of entering a recession in 2023. India’s appetite, especially in the short term, could help make packers reluctant to add further commitments, which could help prices rebound.

A larger average kernel size could also help California handlers realize growth in the coming year. Smaller almonds are really only suited for the EU and Domestic markets, so a shift in size to provide larger kernels could give handlers more options on where to sell. This could help continue to fuel emerging markets in the Middle East and North Africa and give more velocity to India shipments. If all of these scenarios materialize, prices could move significantly once the carry forward has been worked through and shipment demand accelerates.

There are headwinds to growth however, as the EU and the US continue to battle inflationary conditions and economists continue to be weary of possible recession. However food commodities have proven resilient in economic downturns and a return to normalized buying patterns could actually set both markets up for growth.