February 2024 Almond Market Report

Per February's Position Report, California almond handlers shipped over 221 million pounds in February. This is a decline of -10% YoY. The decline was lead by export markets, which were down -13.8% YoY. Domestic shipments however saw a modest lift, up +2.3%. On the crop year export shipments pace +7.77% growth, while domestic shipments are flat at +0.18%.

Handlers added 214 million pounds of new contracts in February. While contracted shipments currently on the books lag behind last year’s figure -19.6%, newly added monthly commitments have exceeded their pace from a year ago for three consecutive months. That said, buyers have been effectively adding new commitments to match the pace of shipments leaving California facilities underscoring the reality that buyers continue to be happy buying hand to mouth.

Projecting Demand

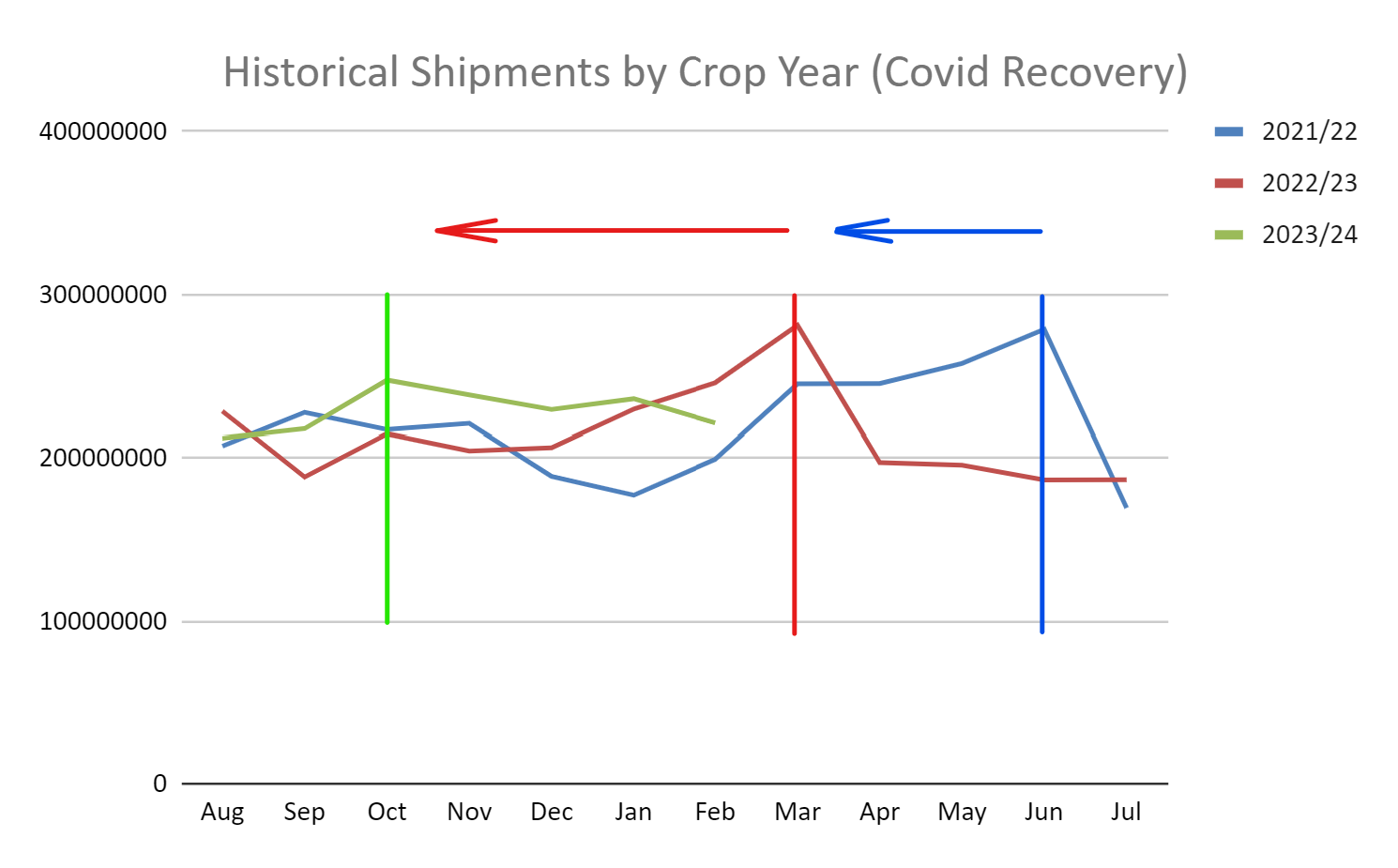

Last March shipments topped 281 million pounds making it not just the busiest March on record, but the 2nd largest shipment month ever. California handlers are not going to approach this figure this March. It should also come as no surprise that February’s shipment figure lagged behind a year ago as we have observed demand cycles continue to shift back to pre-pandemic buying patterns. February and March last year represented an echo of a shifted peak demand period that Covid-stressed supply chains had created. Now it appears that demand cycles have mostly normalized meaning the demand spike we saw a year ago February - March was never going to materialize. Here’s a couple of charts that illustrate this point:

This first chart shows current shipments by month over the past two crop years along with the current year’s shipment figures. Notice the shifting peak demand curves back towards the October time frame we observed this year.

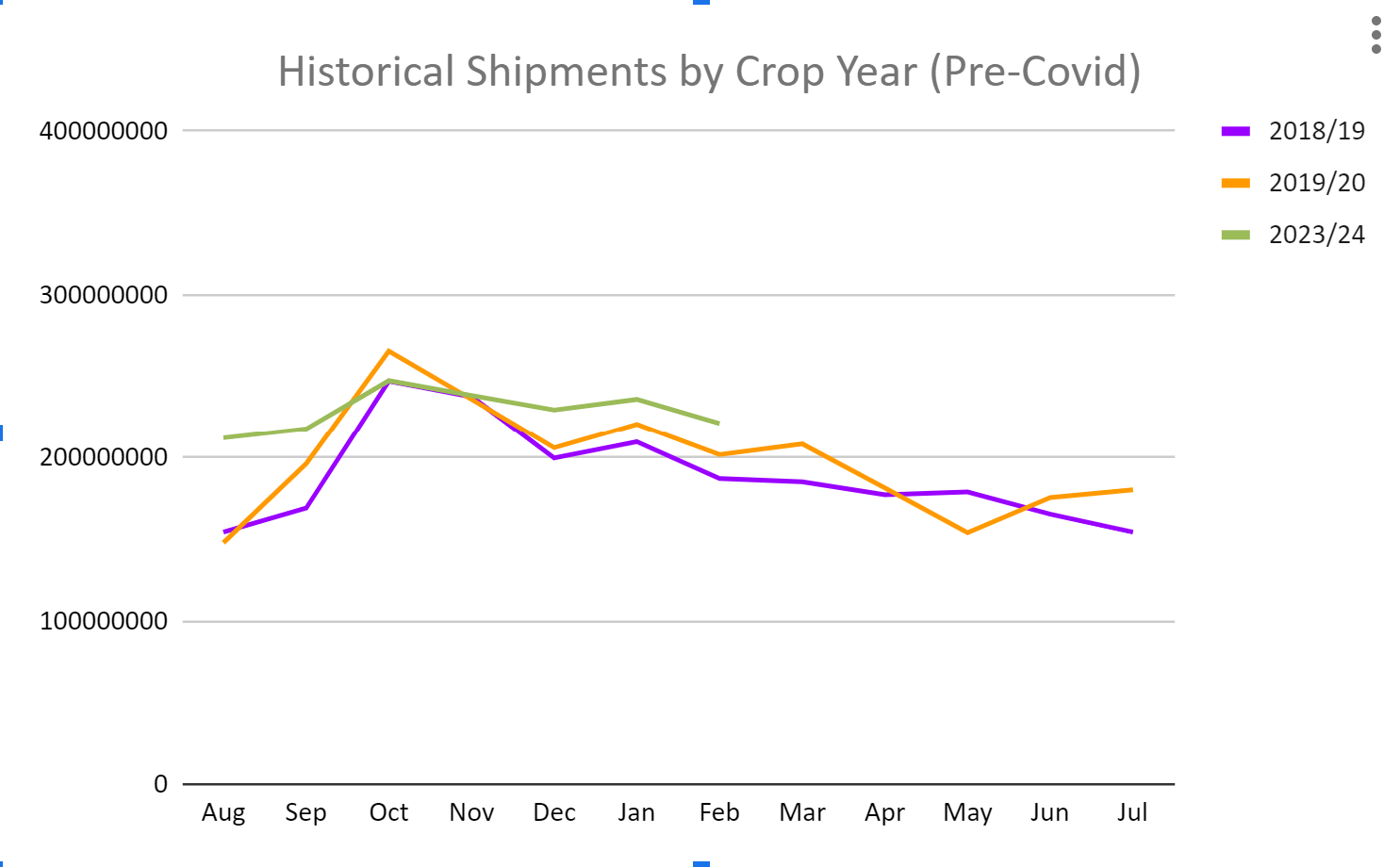

The peak is not as pronounced as what we observed as the Industry adjusted after Covid, and there may yet be some additional supply chain shifting occurring, but the primary shift is clearly present. Now compare this year’s shipment figures with the pre-pandemic crop years of 20218/19 and 2019/2020.

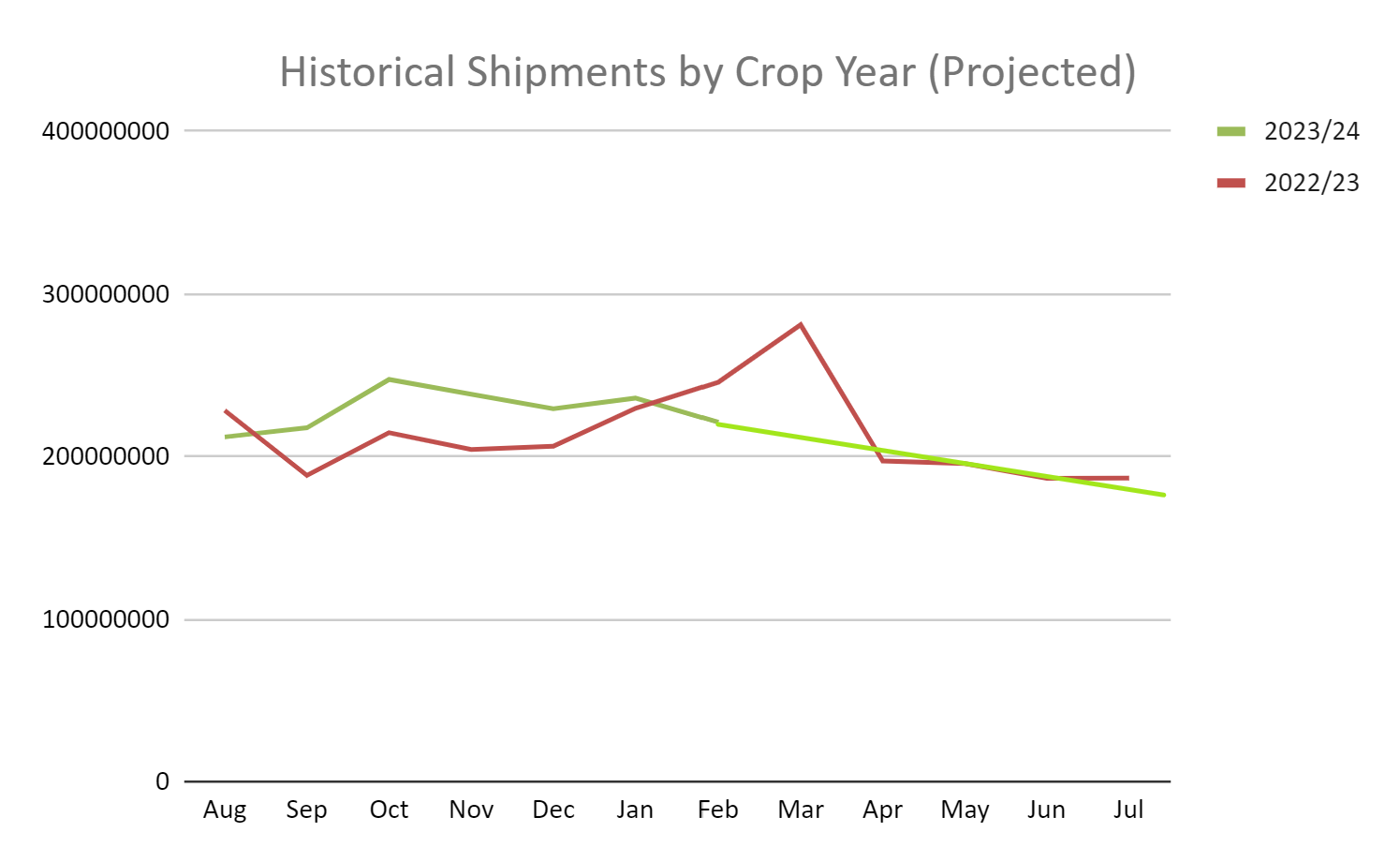

Notice the similar arc where October marks peak demand with a slow taper through the spring and summer off the peak. This is the arc we are currently on and seem likely to continue on. So if one were to project a general demand curve forward for the crop year while comparing it to a year ago, the results might look like this:

The net result suggests we should expect a shipment figure well below last year in March with figures roughly on par with last year beginning in April and through early summer. With a trend line similar to 2019/20, it would be reasonable to 2019/20 as a means to project current shipments into the future. Current figures are about +9% ahead of 2019/2020 at this point in the crop year. If we used that growth figure to project final shipments, we’d get roughly 2.58 billion pounds in total shipments this year. That’s comparable to the 2.56 billion pounds the Industry shipped a year ago. That projects California to be on pace to approach 530-550 million pounds as a carry forward figure in July. This is well within the range the Industry has historically targeted when supply and demand are in balance.

Bloom

Active weather conditions during bloom did bring rain, cold days with mornings in the 30s, and significant wind events. However, extended periods of mild weather with ample sunshine were persistent during the early stages of bloom dismissing concerns regarding bee flight hours or other impacts to pollination vitality. While not ideal through the entirety of the bloom season, bloom can generally be viewed as a positive event.

Reduced culture budgets however continue to be a concern. Growers have experienced three consecutive years of significantly below average prices while simultaneously coping with increasing input and labor prices. The unprecedented levels of damage and rejects we saw this season is only one impact we can expect from severely reduced culture budgets. As growers continue to scrutinize all expenses, even the ability to optimize fertilization practices comes into question. Fewer and smaller applications save money, but deficient applications over a period of years can have real and lasting impacts on an orchard’s ability to achieve optimal production levels. So even with a positive start to the growing season, a return to peak production output seems especially doubtful.

Water

With California’s wet season coming to close, water conditions have continued to improve. As of March 11th, California as a whole was averaging 99% of its levels historically seen on April 1st, the traditional end of the rainy season. Water levels in reservoirs that will continue to capture summer snow melt and provide water to California residents and farmers are generally at or above historical norms for this time of year. With ample water supply growers should have plenty of available capacity for the upcoming growing season. With that in mind, this will be our last regular update on water conditions barring any major event or change to general conditions impacting our growing community.

World Demand

For the first time since July, India imported fewer almonds during a month than it had the year prior. It should be noted that India was a driver in the industry-wide demand peak that was occurring last year in February and March. With the demand curve broadly shifting back to historical patterns across the industry, it shouldn't be a surprise that shipments have slowed over a year ago. India still imported over 27 million pounds and is currently up +18% on the crop year as the Industry’s largest export market. India's appetite for almonds should continue to persist as California handlers will continue to field inquiries. However, India's excessive growth and the higher rates of damage seen in this year's harvest means that availability of preferred high quality inshell, and even high end kernel substitutes are beginning to become constrained which may limit India's top end growth potential this year.

China, like India, was a major market influencer during the demand peak a year ago. In 2023, China went from 5.8 million pounds in shipments in January to 21.8 million pounds in February. This year China went from 4.7 million pounds in January to 5.5 million pounds in February. This was enough to reduce China’s growth rate on the crop year from +6% in January 2024 to -14% in February. Ongoing shipments to China may also face similar constraints as those seen in India with inshell supplies and high end specifications becoming less available. That said, China remains a significant market with significant demand for almonds and could well rebound by the end of the crop year.

Elsewhere in Asia, Japan and South Korea continue to boast respectable growth rates for the crop year. Both were generally on par with shipment figures from a year ago and are pacing +10% and +21% growth figures on the year. Vietnam has also continued its growth boosting imports over +250% YoY in February and has more than doubled its imports thus far on the crop year.

Western Europe as a region improved its growth rate from +10% in January to +11% in February for the crop year. As a collective region, Western Europe represents both the largest export destination and the most mature export market for California almonds. Growth in the region is a positive sign for general demand growth for California almonds in general. Stability in shipment figures YoY in February also highlight the reality that Europe was quicker to return to pre pandemic buying trends than most other markets. This reality suggests that the growth currently being observed in Europe is a truer reflection of demand increases than shifting logistical patterns that create false comparisons. At least that’s the optimistic take; but, as we enter the back half of the crop year with Europe showing strong growth figures it is getting harder to explain the pace of buying by any other means other than actual and sustained demand growth.

Highlights in Europe include Germany, which is up +7% as the second largest market with the Netherlands close behind boasting a +34% growth rate. Only three markets in Europe have experienced contraction on the crop year and collectively these three countries have only imported about 6 million pounds combined.

The UAE is pacing +17% growth on the crop year. Turkey is effectively flat up +2% while Saudi Arabia is off -17%. As a region, the Middle East is up +3% having moderated the growth it saw a year ago.

Outlook

Markets are going to continue to grapple with the supply and demand narrative. On the supply side, California seems to be on pace for a comfortable end of year carry forward. At the same time Australia is undergoing their harvest and solid yields there have new sources of almonds coming online. Bloom in California was respectable, but a clear understanding of future yields is still uncertain. While supply and demand have come into balance in the short term, many will recall the oversupply scenarios not that long ago and a positive bloom period may bring those memories closer to the forefront.

On the demand side, shipment patterns have returned to historical cycles. This means California is likely to see shipments that fall short of last year’s figures in the short term, and by year’s end, may not show much YoY growth on net. There does appear to be real demand growth in Europe and India however, which if sustained, could further erode into the projected carryforward. At the very least, sustained growth will require future supply growth heading into the new crop year. Low commitment levels also make it clear that buyers have more buying yet to do.

We will continue to look for signs of continued demand from California’s primary export markets and will look forward to the Subjective Forecast due out in May. By then both supply and demand will have additional time to play their balancing tug of war and our first real look at future supply could truly push the scale one way or another.